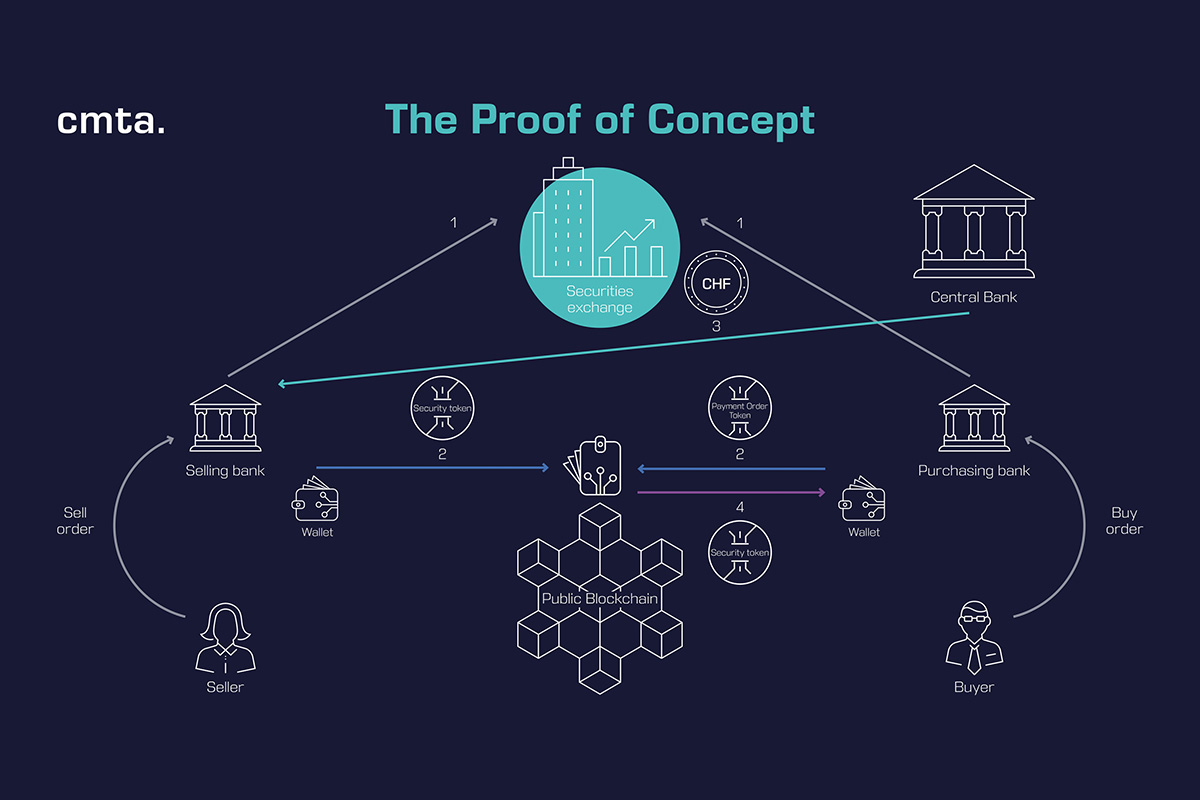

For the first time, key players in the Swiss financial industry successfully developed and tested a novel settlement mechanism for tokenized investment products on a public blockchain testnet infrastructure. A smart contract, developed by the Capital Markets and Technology Association (the CMTA), allows for streamlined processes, reduces complexity, raises security, and eliminates counterparty risks from trades. The CMTA’s proof of concept marks a milestone for the Swiss financial industry.

The proof of concept involves:

- the issuance of tokenized investment products recorded on an Ethereum test blockchain,

- the trading of these products in Swiss francs on a regulated Swiss securities exchange, and

- the settlement of trades through a smart contract developed by the CMTA.

These three distinct operations – issuance, trading and settlement – all happened within hours, when they take days to unfold in a traditional financial environment.

“We are very proud to have developed this groundbreaking mechanism with numerous partners from the financial and technology industries,” says Jacques Iffland, Chairman of the CMTA. “It will enable the industry to increase efficiency, simplify cross-border settlement and improve the quality of service. And customers will benefit from the efficiency gains.”

Vontobel and Pictet each issued an actively managed equity certificate representing a basket of equities, while Credit Suisse issued a structured note, which were associated with digital tokens recorded on an Ethereum test blockchain, a process commonly referred to as “tokenization”. These securities were then traded on the platform of BX Swiss, a FINMA regulated Swiss securities exchange. The trades were settled bilaterally on the blockchain. To do so, the participants used an on-chain mechanism that secures the parties’ obligations. The settlement in fiat currency (Swiss franc) was made possible by an application called DLT2Pay, a product of targens, that connects the blockchain with the Swiss Interbank Clearing (SIC), the real-time gross settlement (RTGS) payment system of the Swiss National Bank. The proof of concept leveraged the CMTA’s standard token format and smart contract (CMTAT), and another smart contract that replicates the delivery-vs-payment functionality of traditional settlement systems. The creation, security aspects and technical operation of the smart contracts, were carried out under the leadership of Taurus, whose technology was used to issue and manage the structured products across their full lifecycle.

The proof of concept was developed and carried out under the aegis of the CMTA, with the support of representatives of BX Swiss, Credit Suisse, Homburger, Lenz & Staehelin, METACO, Pictet, targens, Taurus, UBS and Vontobel.

The proof of concept lays the foundation for an alternative Swiss post-trade infrastructure that functions without central parties (central counterparty and central securities depositary) and enables participating banks to benefit from cost advantages along the entire value chain of securities transactions (issuance, settlement and custody).

Daniel Gorrera, Head Digital Assets at Credit Suisse, said: “The transactions carried out today clearly establish that products tokenized on a public blockchain can be traded on regulated trading platforms and that the settlement of transactions on tokenized products can be carried out in fiat currencies without creating any counterparty risk. The successful proof of concept is a crucial first step for unlocking the benefits of tokenization in the future.”

Steve Blanchet, Head of Group Tech Strategy and Innovation at Pictet said: “Tokenization is a key strategic element for the future of asset management. It enables issuers to streamline the processes that govern the creation of investment products in a way that is currently not achievable with traditional infrastructures, and to drastically reduce time-to-market. With the solutions we tested in the proof of concept, processes that are currently matters of days can be reduced to a few hours, and eventually down to minutes or less.“

Anna-Naomi Bandi-Lang, Structuring – Credit Solutions at UBS Investment Bank said: “Tokenization has many use cases, but for it to become an established feature of modern financial markets, the ability to trade tokenized products in major currencies and through regulated trading venues is key. The CMTA’s proof of concept demonstrates that there is a path to achieve this goal.”

Marco Hegglin, Chief of Staff Structured Solutions & Treasury at Vontobel, said: “This proof of concept is just a first step on the way to defining a new standard for structured products in the form of a smart contract. Structured products are not only innovative products, they are also predestined for state-of-the-art technology. With a fully automated smart contract covering the entire lifecycle, the possibilities that can be expressed in pure code language are almost unlimited, and the blockchain technology can help designing new generations of financial products.”

Matthias Müller, Head of Markets at BX Swiss, said: “First of its kind, this proof of concept demonstrated that trades carried out on-exchange can be settled on a public blockchain directly between participants. It is no longer necessary for the parties to secure a transaction by transferring tokens or cash to the exchange ahead of trade. This is a significant advantage in terms of speed, cost, and risk management. The smart contract used for the settlement eliminates the counterparty risk that would exist if the cash leg and the asset leg of the transactions were completed independently from one another. The new regulatory regime for DLT-based trading platforms will allow BX Swiss to take full advantage of these developments.”

Jean-Philippe Aumasson, co-founder of Taurus SA and Chair of the CMTA’s Technology Committee, said: “We are delighted to see a consensus building around the use of open standards for DLT-based market infrastructures and to see that the CMTA’s smart contracts are being recognized as reliable technology in this respect. Using collaboratively developed open-source smart contracts reduces development and due diligence costs for participants and contributes to the reliability and efficiency of the Swiss fintech ecosystem.”

Samuel Bisig, Business Development and Product Manager at targens GmbH in Stuttgart, said: “targens’ DLT2Pay solution provides the missing link between a DLT/blockchain and a payment transaction protocol (here: central banks’ clearing systems) for the cash settlement of securities transactions. As long as central bank digital currencies (CBDCs) are not available, such a “trigger solution” is key if digital assets are to be traded otherwise than in private cryptocurrencies.“

as a financing instrument. In a pilot transaction, leveraging the technology built by the

as a financing instrument. In a pilot transaction, leveraging the technology built by the