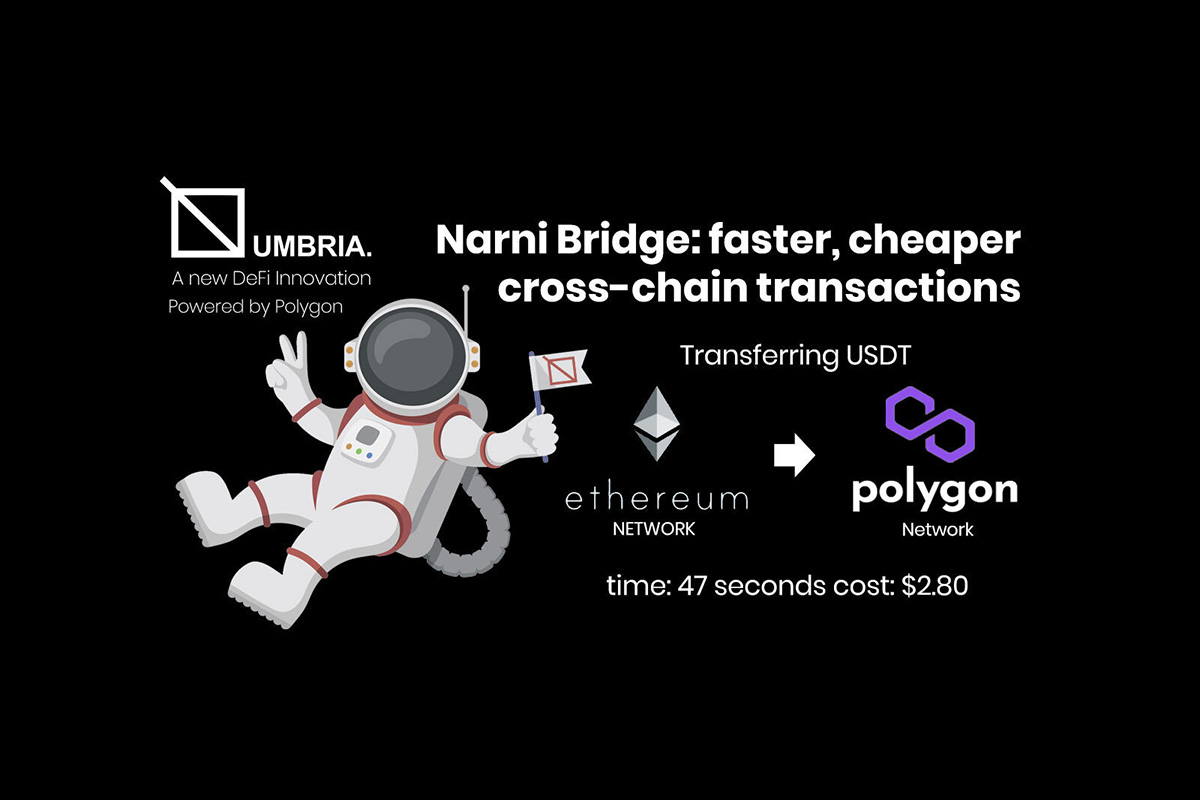

MATIC, the native token for the Polygon Network, can be migrated cross-chain almost instantly and at minimal cost using Umbria’s Narni Bridge – bridge.umbria.network.

The popular token, which is currently ranked 20 of all crypto assets in terms of market cap, can be transferred with the Narni Bridge at approximately a 90% discount to other solutions. A typical transaction for MATIC takes less than four minutes and often costs just $4-$9 to transfer from Ethereum to Polygon.

In addition to benefitting from incredibly fast and inexpensive transactions, users of Narni can put their $MATIC to work by lending it to the bridge to earn interest on this asset. With Narni’s ‘pool and earn’ feature (https://bridge.umbria.network/pool/), liquidity providers (LPs) receive fees when other participants bridge MATIC between networks.

The ‘pool and earn’ feature is particularly lucrative for anyone staking $UMBR – Umbria’s governance token. These liquidity providers earn their share of a 0.3% fee, whenever anyone transfers any of the assets supported by the bridge (including MATIC) cross-chain. The rewards earned are paid in the assets used to bridge between networks and are added to the staking balance of each token on the respective network. Unlike many other platforms, where users provide liquidity as a pair of two different tokens and can lose upside due to the change in value of the underlying assets, on Narni there is no impermanent loss as only one asset is provided as liquidity.

Wednseday 17th, November saw the Narni bridge record its highest volume of transactions.

“Polygon solves many of the significant limitations of the Ethreum Network chiefly poor throughput and high gas fees, which is making it an increasingly popular platform for DeFi and NFT projects to build on including ourselves,” said Oscar Chambers, Co-lead developer at Umbria. “As its market share and TVL increases so does interest in its native token MATIC. We’re seeing this first hand and are thrilled to enable users to bridge this asset incredibly cheaply, easily and quickly; and to earn APY.”

For more information about the bridge see the Umbria documentation page: bridge.umbria.network/docs and for feedback, questions and the very latest news about the Narni Bridge please head to our Discord channel.

See the latest data on UMBR on CoinMarketCap and CoinGecko: