A news report from Business Next Media Group:

The 3-day 2023 AI TAIWAN Future Commerce ended successfully on 6/17 (Sat) in Taipei. With the main theme as “AI FOR ALL”, the fair contained ten solution exhibition areas in total, and six new business application theme areas, including more than 200 enterprises to participate in more than 150 wonderful agenda during the exhibition, attracting a total of more than 16,000 people registered, moreover, we hit the record of more than 42,000 visitors in this three consecutive days exhibition, all these participants witnessed upcoming of AI era.

VIP guests come to the scene to feel the charm of generative AI

In view of the goal of 2050 net zero carbon emission, the curatorial team of Future Commerce especially worked with GoodPoint Exchange to create a demonstration area about ESG new business model, where fully presented the new business model of Marine waste, so that the visitors could go through the situation personally, our Vice president of the Executive Yuan Wen Tsan, Cheng also visited this area.

This area is divided into “collection” and “classification and recycling”, showing how to reduce the carbon emission of transportation by more than 30% through cross-industry and cross-departmental collaboration, from cleaning the ocean and the beach, then transport the waste, ends up to make 100% recycled furniture from sea waste raw materials. At the same time, companies will be given a report detailing their contribution to the environment through the use of these furniture, which will become part of the annual Corporate Sustainability Report, increasing the incentive for companies to participate in ESG.

In order to offer our participants a more comprehensive imagination about “AI FOR ALL”, we had the Future AI area on site. Since 2019, the Ministry of Digital Affairs has continued to promote the “AI Application Development Environment Promotion Plan”, with two main axes: Industrial AI and AI industrialization. As the highlights of the exhibition this year, the Ministry of Digital Affairs led potential AI solution providers such as: FAST AI, Aeolus Robotics, OmniEyes, Smart Ageing Tech, iAMBITION TECHNOLOGY, Tachyon Intelligence Robot, Gogolook, GRAPHEN TAIWAN, showing the industrial application of AI, attracting people to stop by and experience.

In addition, 2023 AI TAIWAN Future Commerce understands the infinite possibilities of the future sound economy, so during the fair, we had limited event to invite the audience to experience being Podcaster, personally feel the real working environment of recording Podcast, even Shi si, Wang, Vice Minister of Culture, also contributed her voice.

She especially mentioned when recording Podcast that the application of generative AI will bring enterprises more alternative choices in work, and in this stage of technological growth, we should focus more on how we can create value and bring maximum benefits with AI collaboration, and Shi si, Wang also firmly believes that the era of AI is a moment that will bring a better future and is worth looking forward to.

All industry viewpoints once in place, the eye-moving viewing experience attracts 30,000 interactions

Not only VIP guests visit 2023 AI TAIWAN Future Commerce, more than 150 events are on the agenda, the industry’s top lecturers share first-hand views, and filled the exhibition with lots of knowledge.

At a conference called “Microsoft Generative AI Practice Forum”, the director of Administration for Digital Industries, Zhenghua, Lu said that generative AI is reshaping the new look of future work, so that all industries can become more competitive because of the introduction of generative AI, and bring more inspiration to the market, the Administration for Digital Industries will also work together to establish the entire ecosystem.

Flora Chen, COO of Microsoft Taiwan, shared that enterprise resilience is the key when facing a crisis, and relying on AI assistance will be able to work more efficiently to enhance production capacity and create more work value.

“MarTech” was not only the area with the most stands in this exhibition, but also the most popular speech section of the Forum. Speakers such as Ben Yu, Youtube Greater China Strategic Partner Director, Susan Wang, general manager of LINE Taiwan Enterprise Solutions Business Group, and Andy Yeh, general manager of OneAD shared the importance of customization commerce in the future industrial world. Apart from continuing to uphold the core value of “people-oriented”, the enterprises must learn to display data-driven insights in a creative way, and respond rapidly to market changes, are the key elements of the brand to stand firm in the market and expand business.

Another highlight of 2023 AI TAIWAN Future Commerce is that we cooperated with LINE Biz-Solutions, +ing and Crescendo Lab, introduced eye tracker +Beacon technology, using LINE official account as the platform, provide the most personal experience for each visitor, with only a glance, you can get all key information about the exhibition. In the three days exhibition, create a total of more than 30,000 interactions, at the same time to strengthen the perfect integration of online and offline, we also built an online information desk to meet the needs of visitors in finding stands, looking for maps and activities, up to 30% of the participants believe that this is a great help to the exhibition.

2023 AI TAIWAN Future Commerce has always believed that encountering the fast pace and challenging market, only flexible, innovative and constantly integrating business models have the opportunity to develop sustainably. Driven by the theme of “AI FOR ALL” this year, it also allows people from different fields such as marketing, science and technology to see how many possible scenarios generative AI will bring, and look forward to more blooming applications in the near future.

By the theme of “AI FOR ALL” this year, it also allows people from different fields such as marketing, science and technology to see how many possible scenarios generative AI will bring, and look forward to more blooming applications in the near future.

SOURCE Business Next Media Group

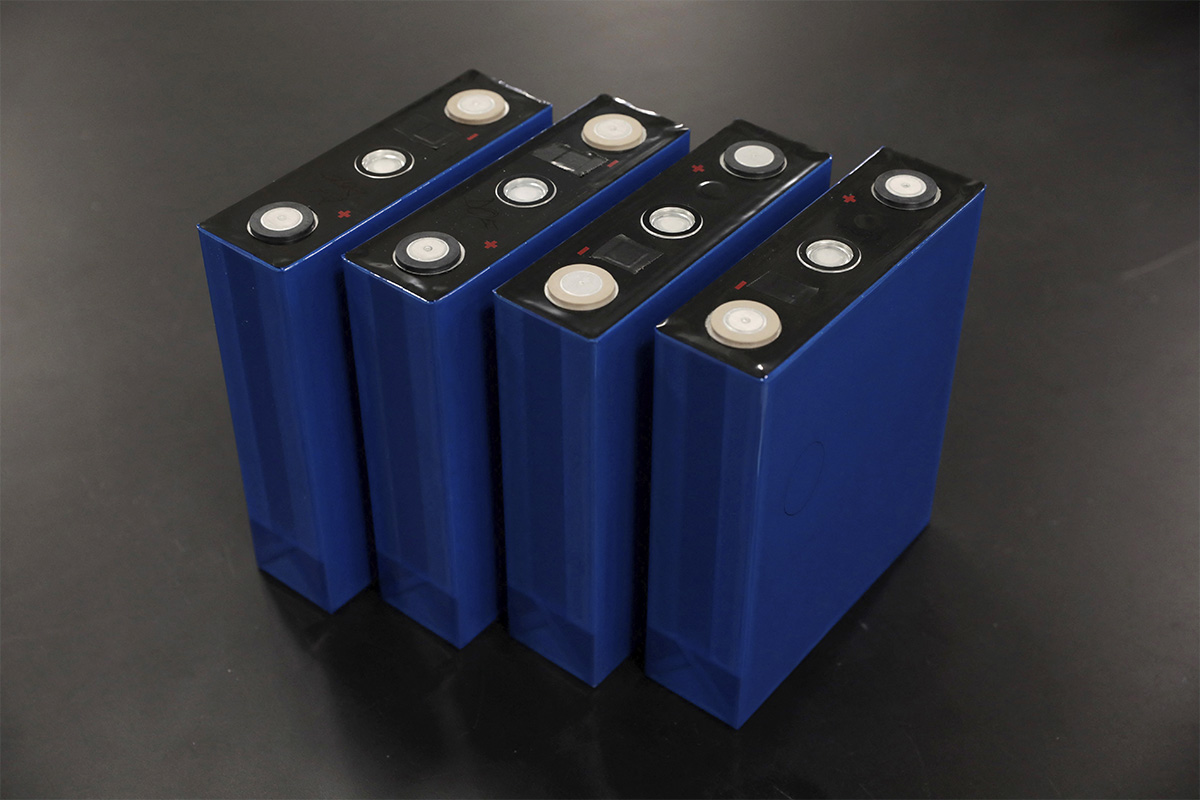

. Lithium Iron Phosphate (LiFePO4) batteries, also known as LFP batteries, are a type of rechargeable lithium-ion battery chemistry. They are composed of a cathode made of lithium iron phosphate and an anode made of carbon. LiFePO4 batteries are known for their high energy density, long cycle life, and excellent thermal stability. The market growth of LFP is driven by substantial need for battery-operated material-handling equipment. Transition from conventional power generation to renewable generation present promising opportunities for the lithium iron phosphate batteries market. However, the risks associated with disposal of spent lithium-based batteries has hindered the growth of the market in recent years and is expected to restrain the market’s growth during the forecast period.

. Lithium Iron Phosphate (LiFePO4) batteries, also known as LFP batteries, are a type of rechargeable lithium-ion battery chemistry. They are composed of a cathode made of lithium iron phosphate and an anode made of carbon. LiFePO4 batteries are known for their high energy density, long cycle life, and excellent thermal stability. The market growth of LFP is driven by substantial need for battery-operated material-handling equipment. Transition from conventional power generation to renewable generation present promising opportunities for the lithium iron phosphate batteries market. However, the risks associated with disposal of spent lithium-based batteries has hindered the growth of the market in recent years and is expected to restrain the market’s growth during the forecast period.

. The Residential Energy Storage Market has promising growth potential due to the rising production of electric vehicles, initiatives by government, growing R & D investment in lithium-ion batteries.

. The Residential Energy Storage Market has promising growth potential due to the rising production of electric vehicles, initiatives by government, growing R & D investment in lithium-ion batteries.