Automotive Fuse Market by value is projected to grow at a CAGR of 2.0% from 2022 to 2027, to reach USD 28.4 billion by 2027 from USD 25.7 billion in 2022, according to a new report by MarketsandMarkets . The market for automotive fuse is increasing due to factors such as rising focus on increase in vehicle electrification, safety & comfort features in mid-segment vehicles and increasing sales of electric vehicles.

. The market for automotive fuse is increasing due to factors such as rising focus on increase in vehicle electrification, safety & comfort features in mid-segment vehicles and increasing sales of electric vehicles.

Browse in-depth TOC on “Automotive Fuse Market”

328 – Tables

62 – Figures

263 – Pages

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id= 166444080

“>100A Automotive Fuse Market estimated to be the fastest growing market among the ampere segment”

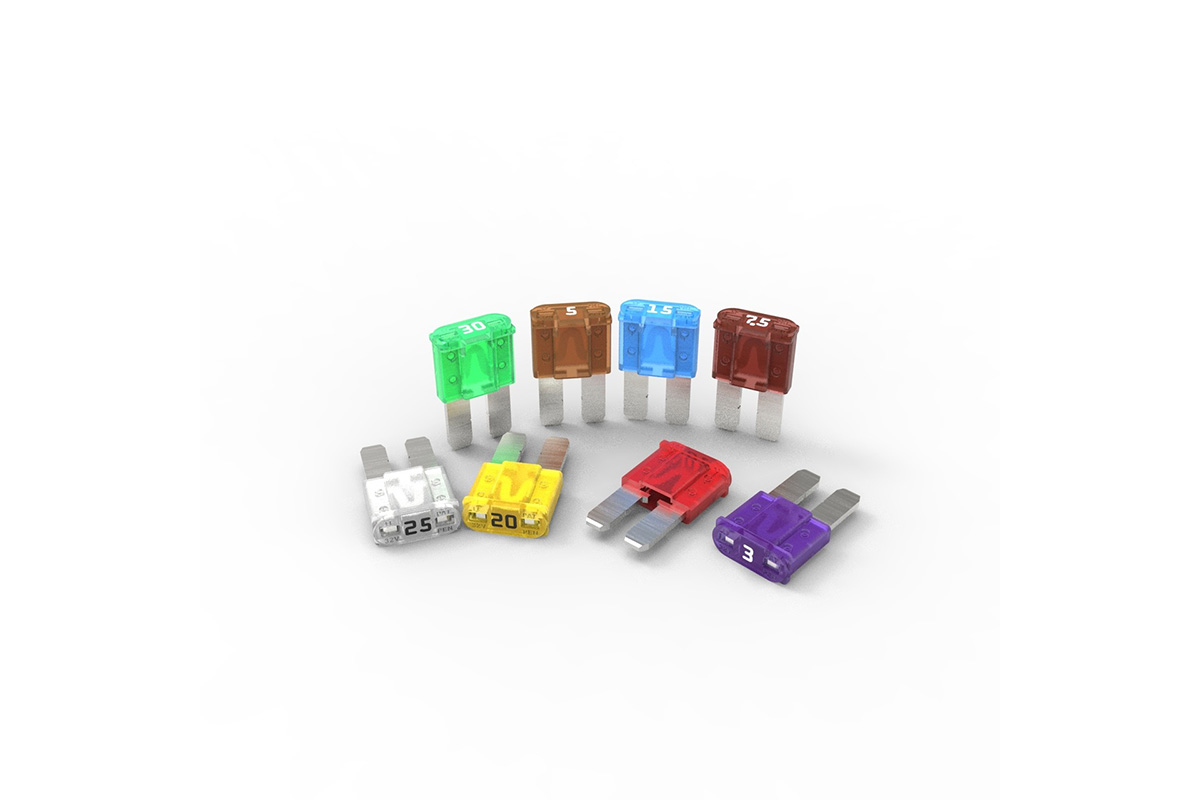

The >100 A fuses are used in battery-related circuits and high-power traction-related circuits. The application of >100 A fuses is higher in battery-related circuits electric vehicle batteries carry high currents. Semiconductor fuses are starting to replace blade fuses in high-current applications since they act very fast in current fluctuations and can handle multiple circuits using a single fuse. >100 A automotive fuses are used to offer protection for high amperage vehicle circuits.

“151-300V fuse market to grow at the fastest pace in the Automotive Fuse Market by voltage”

In this voltage segment, most HEVs and some PHEVs with a voltage architecture range of 150–300 V have been considered. The characteristics of fuses depend on the voltage architecture of the vehicle. The 151–300 V architecture uses more battery fuses than 48–150 V architecture. Some of the vehicles with 150–300V architecture are the Kia Niro Hybrid, Toyota RAV4, BMW 2 Series, and Toyota Prius PHEV. High voltage cables in electric vehicles move power to and from the battery and various systems throughout the electric vehicle. The high voltage architecture of electric vehicle connects the charging port and the battery, battery inter wiring, the battery, and the engine and other electrical components to carry the electric current power which will drive the market for automotive fuse. Hence, the market for automotive fuse of 151-300 V will rise in future with rising market for HEVs and PHEVs.

Request FREE Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id= 166444080

“North America is estimated to be the major market owing to increase in vehicle safety and comfort features”

The US leads the Automotive Fuse Market with the highest Passenger car, LCV and HCV sales in the region. The US is the leading market in the Automotive Fuse Market for EVs in line with the highest EV sales in the North American region. North America is home to Ford Motors, General Motors, and Fiat Chrysler Automobiles. The North American Free Trade Agreement (NAFTA) has fostered the growth of the automotive industry in the region which is driving the Automotive Fuse Market The US, traditionally a global technological leader, is the largest automotive market in North America. Here, a large customer base and high disposable incomes fuel the demand for vehicles and result in increased manufacturing activities by local automotive OEMs. The sales statistics of North America indicate a promising growth potential, particularly for LCVs and HCVs, which dominate the market.

Key Market Players

The Automotive Fuse Market is dominated by a few globally established companies such as Eaton (Ireland), Schurter Group (Switzerland), Littelfuse (US), Sensata (US), Mersen (France), Pacific Engineering Corporation (Japan), Optifuse (US), AEM Components (US), E-T-A (US), ON Semiconductor (US) and Fuzetec (China).

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id= 166444080

Browse Related Reports:

Automotive Pumps Market by Type, Technology (Electric, Mechanical), Displacement, Vehicle Type, Sales Channel (OEM, Aftermarket), EV (BEV, HEV, PHEV, FCEV), Off-Highway Vehicles, Application and Region – Global Forecast to 2027

Automotive Camera Market by Application (ADAS, Park Assist), View Type (Mono, Surround & Rear View), Technology (Thermal, Infrared & Digital), Level of Autonomy (L1, L2&3, L4, L5), Vehicle type & Class, Electric Vehicle & Region – Global Forecast to 2026