In a holiday season where social distancing kept many families and friends apart, Canadian shoppers polled compensated by spending an average of $735 – the highest amount since the RBC Post-Holiday Spending & Saving Insights Poll began tracking these expenditures a decade ago.

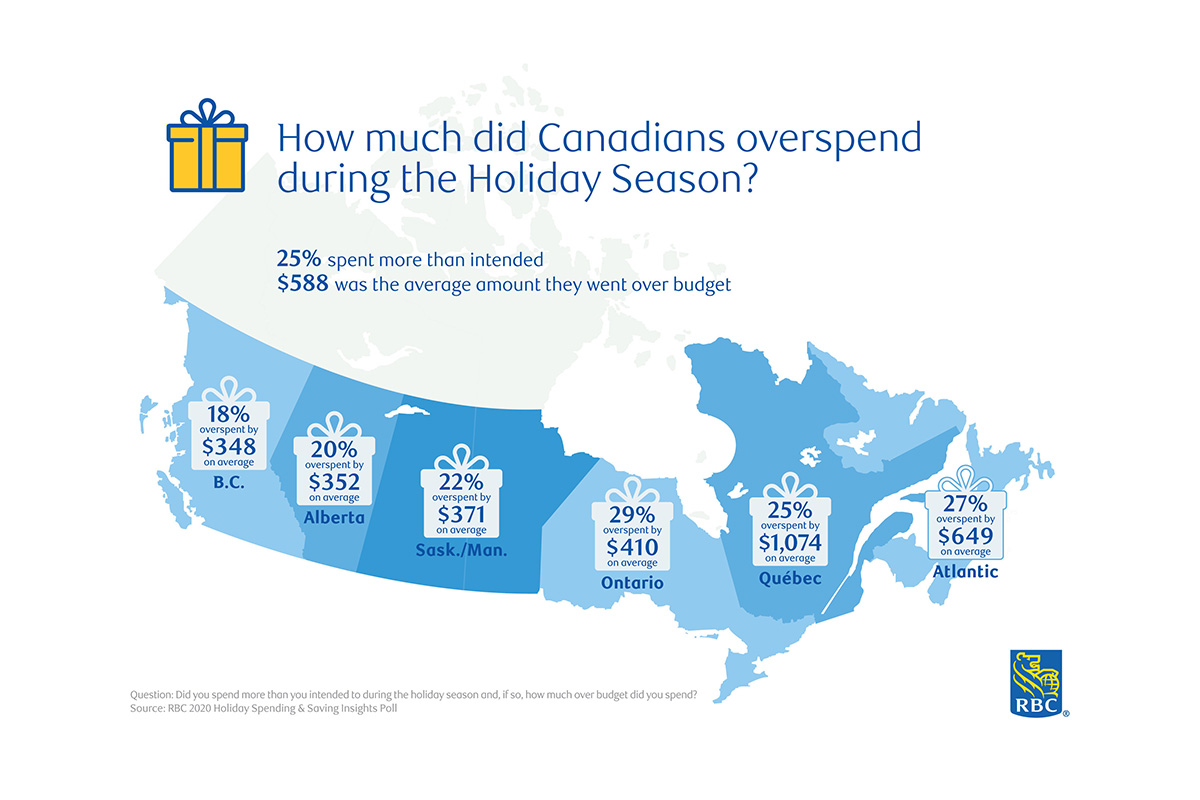

Another record was set by those who spent more than intended (25% of all shoppers), going over budget by $588 on average – a 28% increase from $459 the previous holiday season. The biggest overspenders were in Ontario (29%), followed by residents of Atlantic Canada (27%), Quebec (25%), Saskatchewan and Manitoba (22%), Alberta (20%) and B.C. (18%). By age group, Canadians 18 to 34 included the largest percentage of overspenders (38%); by gender, more men overspent than women (27% vs. 23%).

Two-thirds (67%) of those who spent more than they planned have yet to pay off their holiday bills. One quarter have immediate actions in mind to help take care of those expenses, such as cutting back on entertainment (24%) – one of the biggest holiday season expenditures – and daily living expenses (23%), while 16% expect to carry a balance on their credit card for at least two months.

Overall, Canadians polled identified a number of things they would do differently to prepare for the next holiday season, including setting aside savings on a regular basis (20%) and spending less/resisting any temptations to spend more than they’ve saved (16%).

One of the biggest challenges they now face: how to actually save money throughout the upcoming year. When asked how much extra they might be able to save in 2021, 50% responded ‘I have no idea’ and a further 22% stated they weren’t saving at all right now and didn’t think they’d have anything extra to set aside over the next 12 months.

“We know Canadians have the best of intentions about saving and that it can be difficult to set a budget and stick to it. In these uncertain times, we’re also seeing that, while some are able to save more than they thought because they are spending less, others are struggling to make ends meet as a result of the pandemic,” says Niranjan Vivekanandan, Vice-President, Term Investments & Savings, RBC. “That’s why we have NOMI Find & Save and NOMI Budgets in place, to help clients save and to simplify the budgeting process, regardless of the situation they are navigating. We are here to help in all instances.”

NOMI Find & Save has helped clients save more than $1 billion

NOMI Find & Save recently marked a major milestone in helping Canadians save in an effortless way: it has now found more than $1 billion for clients, since launching in 2017. Over the past year, NOMI Find & Save has helped clients save an average of $358 a month. NOMI Find & Save uses predictive technology to automatically find extra money that it thinks won’t be missed, and sets that money aside as savings. NOMI Budgets uses artificial intelligence to take the thinking and manual calculator work out of creating a budget. It proactively analyzes a client’s spending history, recommends an appropriate budget and sends timely updates to help keep clients on track in a seamless and convenient way.

“When our poll asked Canadians what they would do with ‘found’ money, they had several ideas in mind – including paying down debt (35%), adding to their general savings (32%) and saving for a specific purpose (25%). Very few responded they didn’t know what they’d do with extra funds (8%),” added Vivekanandan. “Imagine what they could do with an extra $358 of ‘found’ money a month!”

RBC Post-Holiday Spending & Saving Insights Poll – Regional & Gender Comparisons

|

ALL RESPONDENTS |

CAN |

BC |

AB |

SK/ MB |

ON |

QC |

AC |

M |

F |

|

Average total |

$735 |

$656 |

$660 |

$737 |

$797 |

$661 |

$906 |

$731 |

$738 |

|

Yes, overspent in |

25% |

18% |

20% |

22% |

29% |

25% |

27% |

27% |

23% |

|

Average overspent |

$588 |

$348 |

$352 |

$371 |

$410 |

$1074 |

$649 |

$616 |

$557 |

|

OVERSPENDERS – |

CAN |

BC |

AB |

SK/ MB |

ON |

QC |

AC |

M |

F |

|

Intend to cut back |

23% |

24% |

18% |

22% |

23% |

23% |

22% |

21% |

25% |

|

Intend to cut back |

24% |

25% |

12% |

22% |

24% |

31% |

22% |

23% |

25% |

|

Will carry on credit |

16% |

17% |

16% |

32% |

16% |

13% |

16% |

16% |

17% |

|

No idea how to pay |

7% |

4% |

2% |

7% |

9% |

6% |

8% |

6% |

8% |

|

Have already paid |

33% |

44% |

39% |

26% |

32% |

28% |

35% |

32% |

34% |

|

ALL RESPONDENTS |

CAN |

BC |

AB |

SK/ MB |

ON |

QC |

AC |

M |

F |

|

No idea how much I |

50% |

47% |

43% |

42% |

51% |

53% |

51% |

47% |

52% |

|

Not saving anything |

22% |

25% |

25% |

33% |

22% |

17% |

16% |

23% |

21% |

|

ALL |

CAN |

BC |

AB |

SK/ MB |

ON |

QC |

AC |

M |

F |

|

Pay down debt |

35% |

28% |

38% |

48% |

35% |

31% |

40% |

34% |

35% |

|

Put into general |

32% |

36% |

36% |

37% |

32% |

25% |

37% |

32% |

32% |

|

Save for a particular |

25% |

27% |

22% |

22% |

26% |

25% |

21% |

22% |

28% |

|

Invest |

19% |

18% |

24% |

19% |

19% |

21% |

11% |

23% |

15% |

|

No idea how I’d use |

8% |

7% |

8% |

6% |

8% |

12% |

3% |

7% |

9% |

|

ALL |

CAN |

BC |

AB |

SK/ MB |

ON |

QC |

AC |

M |

F |

|

Toys |

$77 |

$64 |

$79 |

$70 |

$86 |

$71 |

$82 |

$74 |

$81 |

|

Electronics (mobile |

$104 |

$98 |

$90 |

$97 |

$109 |

$105 |

$118 |

$145 |

$66 |

|

Entertainment |

$62 |

$49 |

$69 |

$56 |

$40 |

$106 |

$52 |

$73 |

$51 |

|

Giving experiences |

$91 |

$110 |

$91 |

$100 |

$78 |

$84 |

$131 |

$108 |

$74 |

|

Gift cards |

$121 |

$106 |

$88 |

$104 |

$127 |

$129 |

$150 |

$135 |

$107 |

|

Gifts for pets |

$31 |

$23 |

$33 |

$26 |

$25 |

$46 |

$34 |

$35 |

$28 |

|

Giving to charities |

$63 |

$55 |

$137 |

$38 |

$59 |

$49 |

$58 |

$89 |

$38 |