Reading Time: 12 minutes

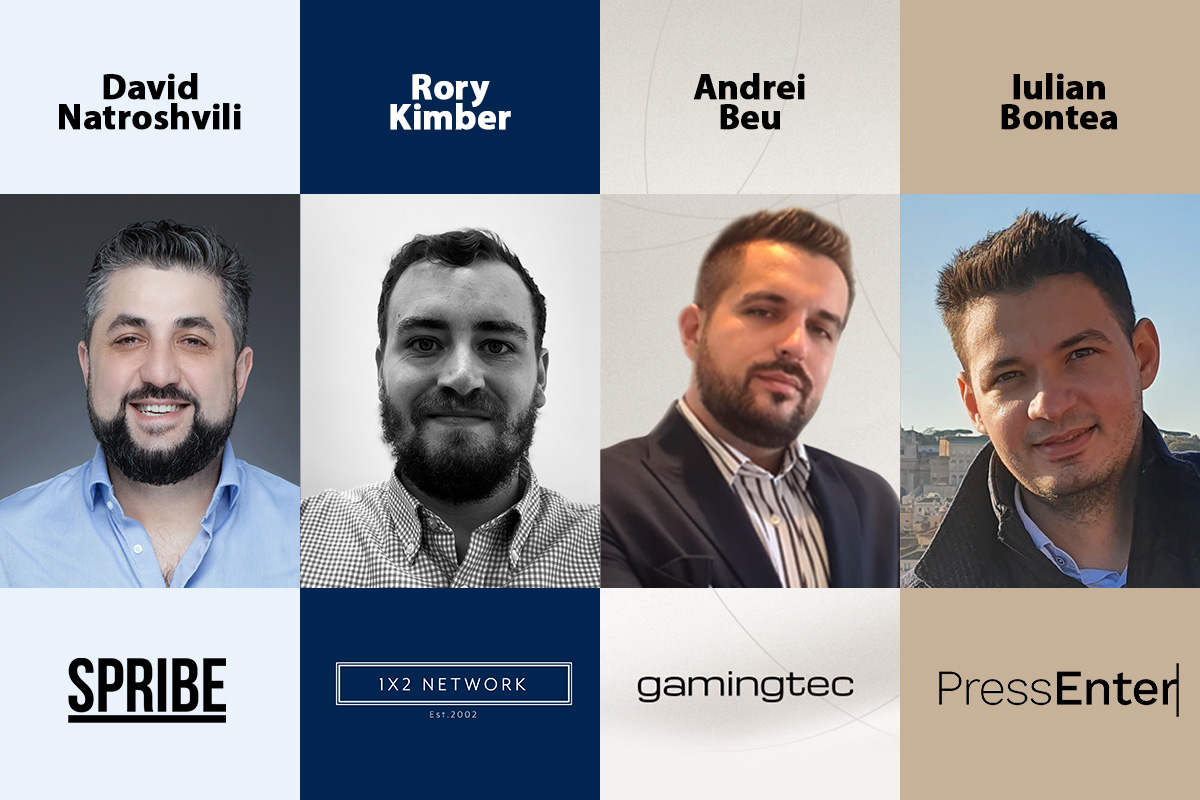

Rory Kimber, Account Management and Marketing Director at 1X2 Network

Romania is an evolving market, with a slew of operators making moves and bringing the weight of their expertise to the market. There are also Romania’s established operators who continue to lead there and push the market in the right direction.

Romanian players have strong influence from land-based casino content, but they are clearly moving through the trends we’ve seen time and again at a similar rate to the players of other markets, if not even faster

We can already see a number of iGaming concepts doing well over there, Megaways obviously is popular across any market, and hold and win titles perform as well, so we’re looking forward to getting our own hold and win series live with our Romanian clients!

Andrei Beu, Commercial Director at Gamingtec

Romania is a thriving market based on solid regulations with both operators and affiliates having to secure a licence to get in on the action. In addition, the tax structure is clearly defined both for operators, suppliers and affiliates as well as players. Romania was rather slow to legalise online gambling which was technically neither legal nor illegal because no legislation existed up until 2010. The government then made online gambling legal, but no regulatory body existed to grant online licenses. The National Gambling Office was then created in 2013 to oversee the country’s gambling industry, and it continues to rule over the industry up to this day.

Iulian Bontea, Country Manager at PressEnter Group

The Romanian market is still in its early days with online gambling having only been legalised back in 2015, but it is a market with an incredibly bright future ahead. The market is regulated with both online sports betting and casino available, with oversight provided by the Romanian National Office for Gambling. The country’s online gambling market continues to grow at a steady pace with around 30 licensees including PressEnter Group now active in the market. There is still a lot of untapped potential in Romania, and we have ambitious plans to be a driver of growth over the coming months and years as we continue to deliver a superior player experience via our UltraCasino brand.

David Natroshvili, Managing Partner at Spribe

The market just keeps growing and growing with the new operators joining every month. Spribe is already currently live with Superbet, FEG (eFortuna, Casa Pariurilor), Superbet, Stanleybet, Betano, Princess Casino and Favbet Romania, with Unibet soon to follow. The last operator on that list is currently pending approval from the ONJN, but once they get the green light from the regulator to enter Romania, we’ll be able to go live with our games there too.

What are your thoughts on the regulations in place? Has the regulator done a good job of creating a viable market?

Rory Kimber, Account Management and Marketing Director at 1X2 Network

Any and all regulation takes time, its a vital process and one that obligates a degree of rigour. Even by this standard – as I’m sure the other contributors will attest – Romania presented particular challenges and has been in the works for some time. The regulators have done a fine job, their implementations seem highly effective while not being too draconian, and they’ve facilitated a viable market; it’s growing, and we’re excited to play a part in that growth.

Andrei Beu, Commercial Director at Gamingtec

The regulations in place combined with the hard work of the National Gambling Office have led to a market where operators, suppliers and affiliates can enjoy great success. During the nine years it took to bring regulations into force, the average gambling spend per player in the country more than doubled. Each year, it became increasingly clear that players were willing to spend money in land-based casinos and online. Post-Covid, the balance has shifted more towards online operators. The market continues to grow at pace, which indicates the regulations in place are appealing to operators and allow them to generate a sizable ROI for their activity in the region while still ensuring players are properly protected.

Iulian Bontea, Country Manager at PressEnter Group

I would say that the regulations in Romania are up to the same standard as those in other European markets and provide an environment in which players are protected while also enabling operators, such as PressEnter Group, and suppliers to run viable, successful businesses. The regulator has done a fine job of blocking illegal, unlicensed brands so the channelisation rates to licensed brands is high. Good regulations are all about balancing the need to prioritise responsible gambling and safe gaming but within a framework that does not put so many requirements and limits on operators and suppliers that the market becomes unviable – as we have seen in Sweden and most recently Germany.

One area of improvement would be in the regulator’s approach to social casino operators. These brands are not covered by the country’s gambling law but as we all know there is a fine line between real-money online casino and social casino. These brands undoubtedly take market share and player spend away from licenced operators so maybe in the future it is something the regulator can and will take a closer look at.

David Natroshvili, Managing Partner at Spribe

The regulator has done incredibly well in creating a viable market in Romania, with the current monthly growth speaking volumes about the job they’ve done so far. In particular, their efforts to block and blacklist unlicensed casinos targeting players in the country is commendable. In May 2020 the National Gambling Office added a further 16 sites to their blacklist, taking the total number of blocked operators to over 70 and ensuring Romanian players could continue to play safely at licensed operators. The regulator’s commitment to responsible gaming is also impressive, with just 0.5% of players considered “problem gamblers” compared to 0.7% in the UK, which is considered the gold standard for regulation.

Is it a market that offers significant potential to operators and suppliers? Why?

Rory Kimber, Account Management and Marketing Director at 1X2 Network.

Absolutely, the Romanian market has some fantastic potential. Simply put, it’s big, and it’s going to get bigger. Romania is a developing country that continues to see powerful economic growth. Their economy has bounced back since 2021 with significant force.

They have a strong affinity with gambling, and with increasing mobile coverage we’re seeing more people shift to online gaming. And with a host of tier one operators at the wheel, the iGaming market segment there has an exciting future.

Andrei Beu, Commercial Director at Gamingtec

Online gambling has been the driving force behind the overall growth that Romania’s gambling industry has enjoyed in recent months and years. Indeed, the online gambling threshold increased by around 90% in 2020. While the pandemic certainly helped push the sector forwards, it is being sustained and this, in turn, is seeing more operators and studios enter the fray. Right now, there are around 30 licensed operators in the market with a growing number of land-based brands on the cusp of launching their own online casinos and sportsbooks.

Iulian Bontea, Country Manager at PressEnter Group

Absolutely. As I mentioned above, it is a new market that is only just six years old. The market is performing well to date with online accounting for a sizable share of total GGR already. There is a history of gambling in the country with an appetite among consumers for online casino and sports betting, and as internet infrastructure continues to improve and smartphone penetration rises the size of the addressable market is only going to grow. That means that Romania could become one of the most significant regulated online gambling markets in Europe over the next three to five years.

David Natroshvili, Managing Partner at Spribe

Yes, we see a big potential in the Romanian market. Between 2017 and 2019, the market more than doubled in size to be worth over 70 million per year – and while recent growth has not been quite so explosive, this figure continues to climb steadily. Of particular importance is the fact that approximately half of Romania’s population is currently between the ages of 18 and 50, which gives operators an audience of around 9 million to target. Not only that, but this young-ish demographic has consistently demonstrated a progressive attitude towards casino gaming, with many players keen to embrace new game formats. This allows us to tap into the psyches of millennial players with innovative new releases such as our Aviator game.

What is the competitive landscape like? Is the room for operators to enter and claim solid market share?

Rory Kimber, Account Management and Marketing Director at 1X2 Network

As a supplier in the industry, I can’t speak for the operators themselves. Although it’s clear as always that some of the huge operators already control swathes of the market. Operators of any size who understand the region and its players will be able to share in the market’s success.

Iulian Bontea, Country Manager at PressEnter Group

With around 40 brands active in the market, including PressEnter Group’s NitroCasino, it is already fiercely competitive. That being said, there is always room for operators that strive to bring innovative and new technologies and experiences to the market to succeed. When this is combined with smart and engaging marketing activity and campaigns, operators can quickly build a significant share of the Romanian market, as they can in any regulated jurisdiction.

David Natroshvili, Managing Partner at Spribe

There’s definitely room for new operators to enter Romania and claim a solid share of the market, but in order to do so, they must be prepared to arrive with a packed library of video slots from a wide range of developers as well as innovative titles that offer never-seen-before gameplay. This is exactly what players in the country are looking for, and operators that can provide this will be able to capitalise on the huge potential offered in Romania, particularly while some of their rivals may be distracted by other breakthrough markets such as the U.S.

What are some of the challenges being faced? How can they be overcome?

Rory Kimber, Account Management and Marketing Director at 1X2 Network

As with any market Romania certainly presents challenges. We can see some operators for whom the country is a top market, and others where it’s an add-on. At times it’s tricky to manage our resource allocation between operators with different levels of attention focused there.

It’s important to understand that the market is founded on its players, so truly understanding the Romanian iGamers must be a priority for operators and suppliers alike. Players are afforded a wealth of choice, so it’s not merely a case of right place right time, operators need to act smartly and in a targeted manner.

Andrei Beu, Commercial Director at Gamingtec

One of the biggest challenges is taxation. The Romanian Ministry of Finance has published its latest Fiscal Code draft featuring a massive 40% tax on casino withdrawals. According to the new Fiscal Code, withdrawals of up to 3,000 RON ($623) would be taxed at 10% while cashouts going over that amount without going over 10,000 RON ($2,079) would be hit with a 20% tax in addition to a 3,000 RON fee. Withdrawals going over 10,000 RON would be taxed at 40% in addition to a 1,700 RON ($353) fee. This may force many players to shift to unlicensed brands to escape these huge taxes on winnings and withdrawals. This will have a domino effect with licensed brands losing players which in turn will hit their profits and ultimately the tax revenues that are returned to the Romanian government.

This is yet to be approved, giving the opportunity for all participants to discuss this new tax framework and to potentially reach a better outcome that wouldn’t harm the gambling industry, the protections that are afforded to players by licensed brands and ultimately the tax revenues that are generated by the sector.

Iulian Bontea, Country Manager at PressEnter Group

The challenge for new online casino brands is that there are established land-based operators that moved into the digital space as soon as the market opened. They have been able to leverage their heritage, brand equity and trust among players to build substantial player bases that are loyal to them. However, new online casino brands that deliver a superior player experience can encourage players away from these established operators and to their online casinos and sports books. If they not only meet but exceed their expectations, they will likely continue to wager with them and not return to the incumbent brands.

David Natroshvili, Managing Partner at Spribe

The regulator is obviously very diligent when it comes to researching brands and deciding who will be permitted to operate in the country. This is – of course – an important and necessary step for any recently-opened market, but initially we faced some challenges with them being a bit slow with the approval process for some of our games. That said, with the market continuing to grow and the regulator gaining more experience from every approval granted, this process is becoming more streamlined and should provide fewer barriers in the future.

Do player preferences differ from other markets? What does localisation look like in Romania?

Rory Kimber, Account Management and Marketing Director at 1X2 Network

As you’d expect, Romanian players do adhere to some of the same trends that we see across other iGaming Markets, however they do have a distinct set of preferences. They have a strong affinity for classic games, low hit rates and a land based feel but at the other end of the spectrum, games with huge potential from low stakes also drive a lot of traffic. There are very few themes that fall completely flat, which means a lot of our content is finding a home and the players are also willing to try out innovative titles. Whilst the pick up for games that are very ‘out there’ is varied, if you find a winner it quite quickly gains market share.

Branded offerings have a growing presence there, we have some fantastic deals lined up to deliver our Branded concepts, which we’re on the cusp of having signed for the market. And we’re seeing newer concepts like crash games and arcade style mine games already resonating with the Romanian player base.

Andrei Beu, Commercial Director at Gamingtec

One important feature of Romanian culture is its collectivism. As such, the group is highly important and protection and loyalty towards the group are greatly appreciated. This trait is mirrored in the business world; strong bonds between different members of a group will play an important role and, consequently, feelings will often go beyond rationality. Like any other business, gambling is not very far from being a victim of this custom. Players will often choose certain games, operators or casino brands based on the preferences of the group they are a part of, without even comparing features, benefits, etc.

With a vast history of wars and various occupations of the country, there are also some important figures that are strongly embedded in our culture, like Vlad Tepes (Vlad the Impaler), Stefan cel Mare (Stefan the Great) and more recently Nicolae Ceausescu (the most famous communist leader of the country). Some operators have had great success by exploiting historical characters, as we can see with Vlad Casino. This can be a difficult thing for operators from outside of the market to understand and leverage, handing a slight edge to those from Romania.

Iulian Bontea, Country Manager at PressEnter Group

Every country has its own DNA and unique player preferences, and Romania is no different. Localisation to PressEnter Group is all about delivering the products and experiences that our players want and that sit perfectly within the country’s culture, language, etc. This covers everything from the games and payment methods available to customer support agents being fluent in Romanian and being available in the local time zone.

David Natroshvili, Managing Partner at Spribe

Unlike in other Eastern European markets where classic slots continue to dominate operator game lobbies, players in Romania tend to favour modern video slots and newer game formats. The average age of the casino demographic plus their willingness to embrace innovation means suppliers have far more freedom to be creative with the titles they’re developing and can use elements from video games and social media in their products. The success of the “increasing curve” format used in Aviator is testament to this fact, with the game frequently seeing 300-350 bets per round during peak periods at many of our casino partners. In terms of localisation, we offer the game rules and our “how to play” video in Romanian, but the straightforward nature of Aviator itself makes it easily accessible to all players in the country.

How will the market develop over the next 12 months?

Rory Kimber, Account Management and Marketing Director at 1X2 Network

The beauty of a market like Romania is that we know it’s going to grow, but it’s difficult to predict how, or in what manner. One thing’s for sure, we’ll be seeing some new faces from both the operator and supplier sides who disrupt things, gaining market share quickly. 1X2 Network has started well but we’ll be looking to grow that presence quickly as we continue to build on what we have learnt.

As we see across other European markets we’ll see the same popular mechanics grow, and their associated gaming concepts expand. What will be interesting is seeing how they clash with themes and mechanics already popular over there.

Bonuses present a particularly interesting area, operators who can capitalise on its popularity and work within the regulations have a lot of opportunity.

Andrei Beu, Commercial Director at Gamingtec

Market changes have evolved to include technological advancements. With the rise of cryptocurrencies and their popularity in the online casino space over the past 12 months, many forecast another year of new trends that will redefine and transform complete areas of the industry worldwide, and this includes in the Romanian market.

Cryptocurrencies will keep making their mark, with more and more online gambling brands accepting crypto this year. Many people enjoy and prefer to deposit, withdraw and play with Bitcoin and other digital currencies because of the security and anonymity they provide. Given the new taxation proposed in Romania, it is very likely we’ll see the appetite for crypto rise even higher.

There has also been an increase in F2P (free-to-play) game products worldwide. This shows that people are willing to spend on entertainment, even if something that is free is not free at all. Both online sports and casino operators are hard at work leveraging this data to their advantage because these F2P players are potential paying customers.

Players are showing a preference for online casinos that deliver a realistic live casino experience from their homes. For many, live dealer is what has allowed them to transition from land-based to online play. Land-based casinos are feeling the burn from their online brands and are facing a sizeable decline with the recent popularity of online gambling sites – this is a trend I expect to continue.

Iulian Bontea, Country Manager at PressEnter Group

I believe that momentum will continue to build in Romania and the market will keep growing at pace. New brands will undoubtedly enter, and the competition will increase, but competition breeds innovation and operators like PressEnter Group that can deliver a best-in-class player experience will be able to claim the lion’s share of the market. That is exactly what we plan to do in Romania and remain committed to the market for the long term.

David Natroshvili, Managing Partner at Spribe

It will continue to grow as the regulator grants more Romanian licenses, which will in turn lead to further innovation as suppliers and operators seek to offer games that meet players’ expectations as to what constitutes a fun and thrilling entertainment experience. Given the success of Aviator and other Turbo Games in the country, this could be a key focus area and we may see Romania distinguish itself from neighbouring regulated markets by moving away from the traditional slot-dominated casino model in favour of something a bit more varied

Anything else to add?

Rory Kimber, Account Management and Marketing Director at 1X2 Network.

Just that 1X2 Network is raring to go with our Romanian expansion, and excited to make our mark.