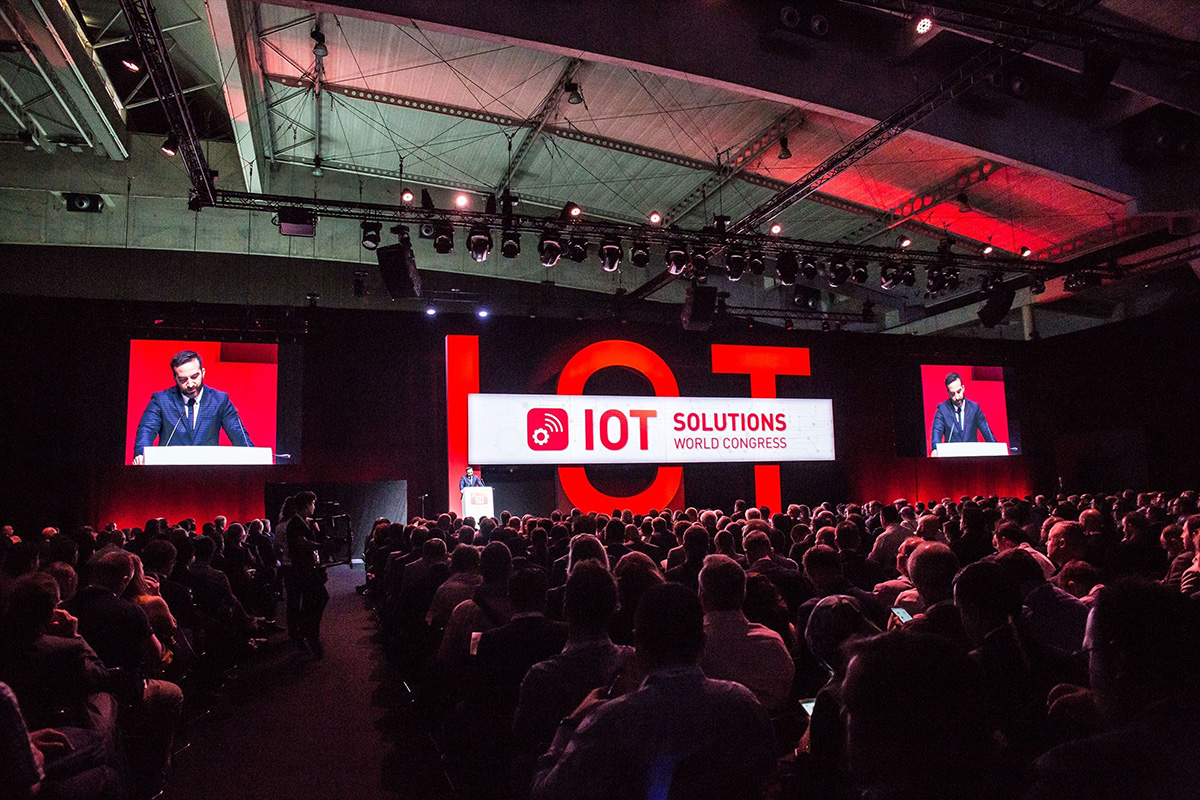

The IOT Solutions World Congress (IOTSWC), the largest international event devoted to industry transformation through disruptive technologies, will hold its sixth edition from May 10 to 12 and will feature over 200 experts in industrial digitalization in its congress program.

Among the speakers is Ann Dunkin, Chief Information Officer (CIO) at the US Department of Energy and author of Industrial Digital Transformation: Accelerate digital transformation with business optimization, AI, and Industry 4.0. In 2016 she was named one of ComputerWorld’s Premier 100 Technology Leaders, and one of Washington DC’s Top 50 Women in Technology in 2015 and 2016.

With a wide experience of the Healthcare industry, Lucien Engelen looks at how new technologies can change patient care models in the context of rising demand for healthcare, shortages of skilled staff and restrictive budgets. He is a faculty member of Exponential Medicine at Singularity University and has advised many companies in business transformation.

The crossroads between sport and technology will be the main focus of the conference of Albert Mundet, Director of the Barça Innovation Hub at FC Barcelona. Mundet will explain how the football club is using Digital Twins to enhance visitors’ experience at the Camp Nou.

Healthcare and technology innovation is the domain of Shafi Ahmed, a colorectal surgeon at The Royal London and St Bartholomew’s Hospitals. A multi award-winning surgeon, teacher, futurist and innovator, Dr. Ahmed has explored the use of augmented and virtual reality as tools to improve healthcare delivery and teaching.

Organised by Fira de Barcelona in partnership with the Industrial Internet Consortium®, IOTSWC will structure its congress program in five horizontal tracks: Business Optimization Solutions, Artificial Intelligence Solutions, Connectivity Solutions, Security Solutions and Customer Experience Solutions. The Congress program will also feature speakers from Airbus; Buhler Group; Johnson&Johnson; Konecranes; Lego Group, Siemens, Toshiba and Volkswagen Group.

Industry transformation reimagined

The event will showcase the solutions of 310 exhibiting companies including ABB, Altair, Amazon Web Services, BrainCube, Crowdstrike, Deloitte, Device Authority, EMnify, Faircom Corporation, Fiware, Hornet Security, Huawei, Kaspersky, KNX, Libellium, Palo Alto, Richardson RFPD, Relayr, Siemens, Sternum and Trellix, TXOne Networks. All of them will display examples of how the Internet of Things, Artificial intelligence, Digital Twins, Augmented and Vistrual Reality, Blockchain and other technologies have the potential to transform entire businesses.