Recently, AEX announced that it will establish a presence in several countries to provide financial derivatives services in line with local markets in order to better serve its users. Founded in 2013, AEX, a well-established exchange, with its blockchain asset storage at the forefront of the world, is one of the few mainstream trading platforms to announce a 100% asset margin.

Over the past 8 years, the number of users converging on the AEX platform to exchange digital assets has reached millions, spreading across more than 100 countries and regions around the world. With the growth of the market scale and the emergence of various cryptocurrency derivatives, AEX has completed its metamorphosis in the direction of a global commercial bank for digital assets, aggregating multiple financial business models such as trading, contracts, finance, loan, DeFi staking, and mining market.

AEX integrates information, community, application market, and financial services such as digital currency trading. AEX now supports the circulation of over 300 tokens such as BTC, ETH, and DOGE, and users can participate in business scenarios such as spot trading, DeFi staking, and liquidity mining. In the AEX community section, users can access a wealth of industry information and interact deeply with global crypto enthusiasts. In addition, AEX can access over 20 fiat currencies such as EUR, SGD, HKD, INR, and IDR will be fully opened to enhance the quality of the resident services.

At the same time, there are considerable differences in cryptocurrency market fever, preferences for business models, and regulatory policies among residents of all kinds of cultures. Moreover, there exist different user interaction habits across regions. AEX’s Strategic Multi-country Presence and differentiated services are designed to meet local regulatory requirements and enable users to “invest safely and grow steadily” in the crypto world.

The composition of AEX’s users is dominated by regions such as the United States, Thailand, Vietnam, Russia, Turkey, South Korea, Nigeria, and Indonesia, all of which are in the hundreds of thousands, and the crypto cities in these countries may become the preferred locations for AEX strategic presence.

SOURCE AEX exchange

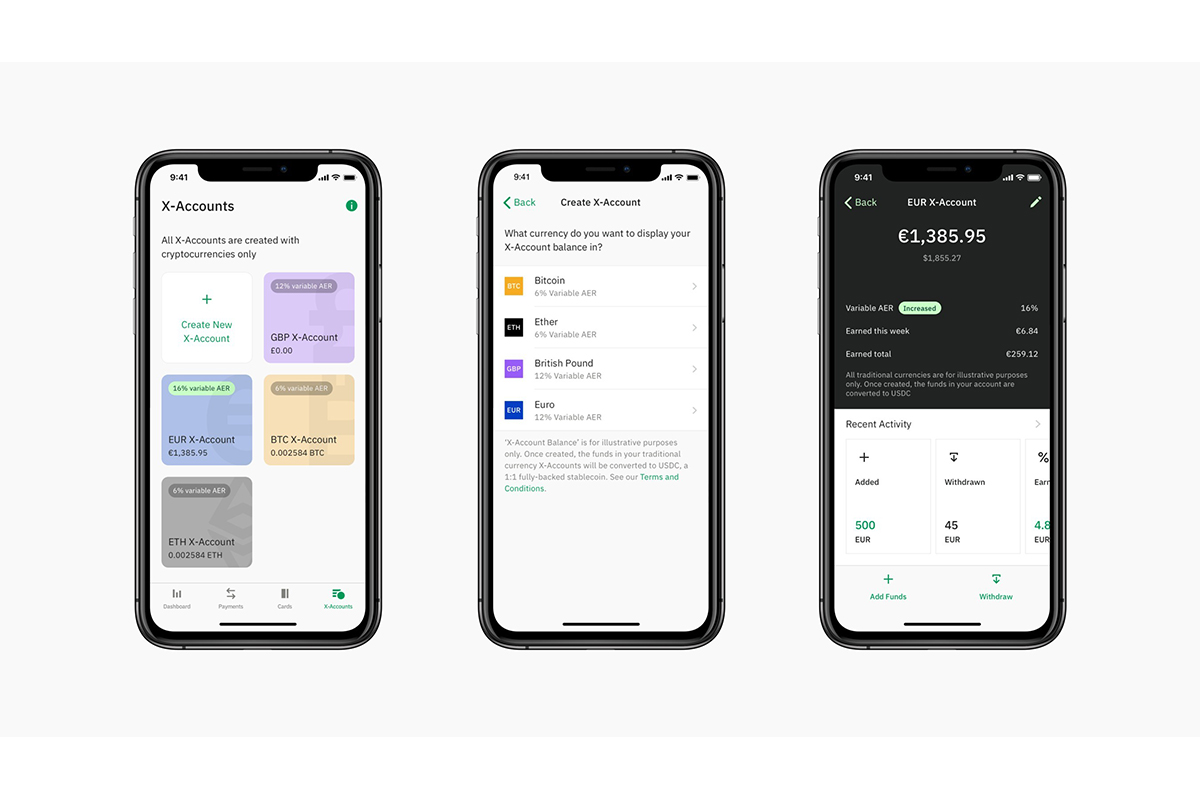

rewards on card purchases, and the ability to hold multiple crypto and fiat accounts with a single intuitive app.

rewards on card purchases, and the ability to hold multiple crypto and fiat accounts with a single intuitive app.