Soldo, the leading European pay and spend automation platform, today announces that it has closed a $180m oversubscribed Series C funding round, a European record for the spend management category.

The fundraise was led by Temasek, a leading global investor headquartered in Singapore.

The round includes new investors Sunley House Capital, Advent International’s crossover fund, Citi Ventures and continued backing from Accel, Battery Ventures, Dawn Capital, and Silicon Valley Bank for debt financing. Goldman Sachs acted as the exclusive placement agent to Soldo for the deal.

This investment follows an impressive 4x growth in spend volume across Soldo’s platform since series B, despite the backdrop of the challenging macro-economic environment.

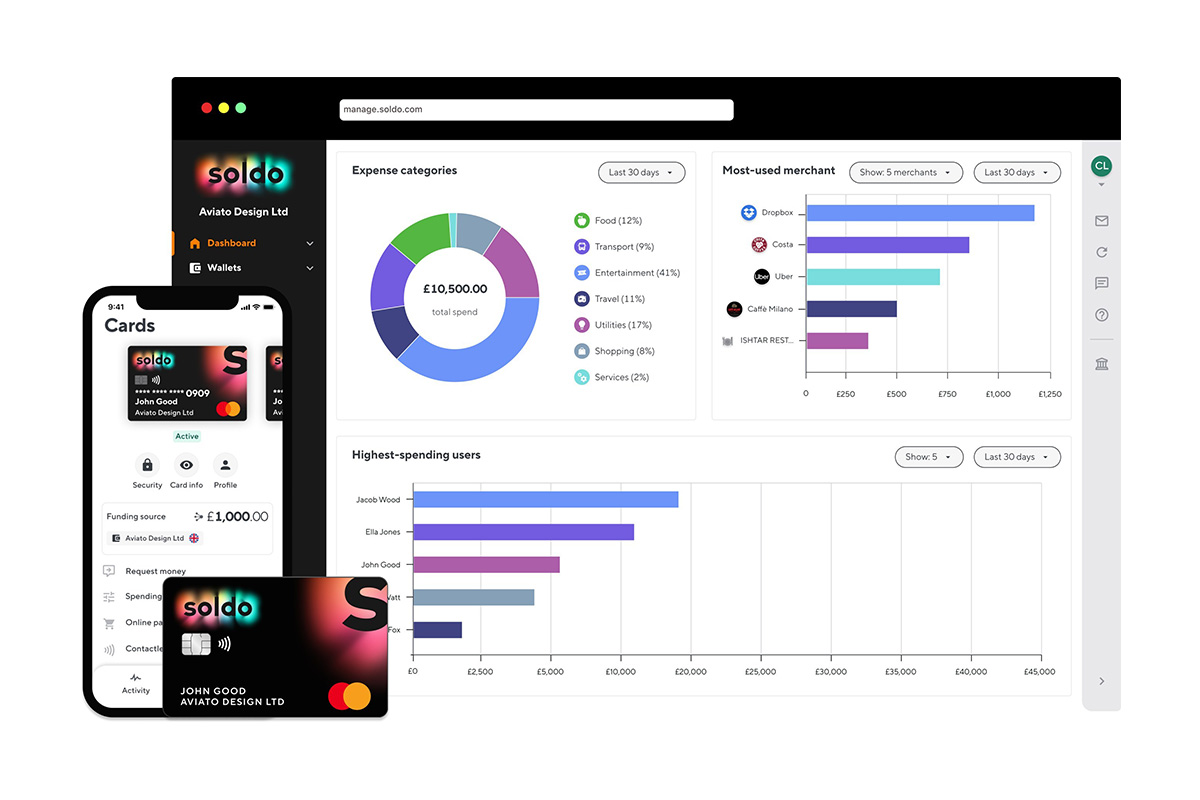

Soldo’s European pay and spend automation platform gives businesses real-time visibility and cost control across all departments. The funding round means Soldo can continue to accelerate product development and market expansion across Europe’s addressable market of $170bn.

Serving more than 26,000 customers from small and mid-market to global enterprise in more than 30 countries, Soldo is best positioned to help businesses to manage their spend. Whether that is across travel and entertainment, online advertising, vendor management, software subscriptions, or anything else. Its customers include Mercedes Benz, GetYourGuide, Gymshark, Bauli, and Brooks Running.

Carlo Gualandri, CEO and Founder of Soldo said: “We are delighted to welcome Temasek as the lead investor. With a track record of investing in category-leading fintechs, Temasek’s insights will be valuable to us as we scale our platform and offering. Managing business spend is costly and challenging, yet Soldo continues to demonstrate its value and ease to customers of every size and across every industry. It’s clear this category will see exponential growth as more businesses realise the benefits and Soldo is well placed to support them.”

Traditionally, corporate payments have had a handful of methods: bank transfers, corporate credit cards. Each of these methods bring a unique set of administrative hassles and security risks. And, of course, once the transactions are complete, there is a haze of receipts, expense reports, classification and reconciliation, budgets, and analysis – none of which is connected. Soldo is the digital solution to this incredibly costly challenge.

Simon Lambert, a director at Sunley House, Advent International’s crossover fund, said: “We are very excited to invest in Soldo. Our experience in software and payments technology gives us deep insight and we are confident Soldo stands at the forefront of finance digitalisation. The company operates in a large and fast-growing market, and we are thrilled to partner with its outstanding management team as they seek to build Europe’s leading pay and spend automation platform.”

Soldo’s spend management platform, built over the last five years, is based on a fully owned technology stack, supported by regulated financial services and payments infrastructure. The platform allows Soldo to innovate faster and integrate with the leading accounting software including NetSuite, QuickBooks, Zucchetti, and Xero, and customers can connect with 50+ expense management platforms including Concur and Expensify via Mastercard Smart Data.

Luis Valdich, Managing Director, Citi Ventures said: “Citi Ventures has been impressed by Soldo’s compelling strategy and market-changing mission to help businesses manage and control spend more efficiently. We look forward to supporting the company as it further expands its platform and transforms the future of business spend.”

Soldo also simplifies the everyday life of employees who regularly deal with painful expense reports, lost receipts and often end up out of pocket. The mobile app facilitates receipt and transaction capture right at the point of purchase.

Mariano Dima, Soldo President said: “We know senior finance employees and CFOs currently spend more than half of their time on cumbersome tasks, and the biggest reason for this is due to disconnected payment systems and manual, time-consuming processes.

“In a study of CFOs and finance directors, Soldo revealed weak spending controls are costing European businesses 2% of their annual turnover through the pandemic. This is a costly reality that Soldo aims to eradicate – by making employees’ lives easier and businesses more aware of all costs – because only then will they be able to truly control their spending and be prepared to prosper post-pandemic and beyond.”

Soldo closed $61 million in Series B funding in July 2019 and has since significantly increased the size of its business with more than 200 employees across offices in London, Dublin, Rome, and Milan. The latest funding round will see the company deepen its focus on new markets including Benelux, France and Germany where Soldo sees immense potential for hyper-growth.