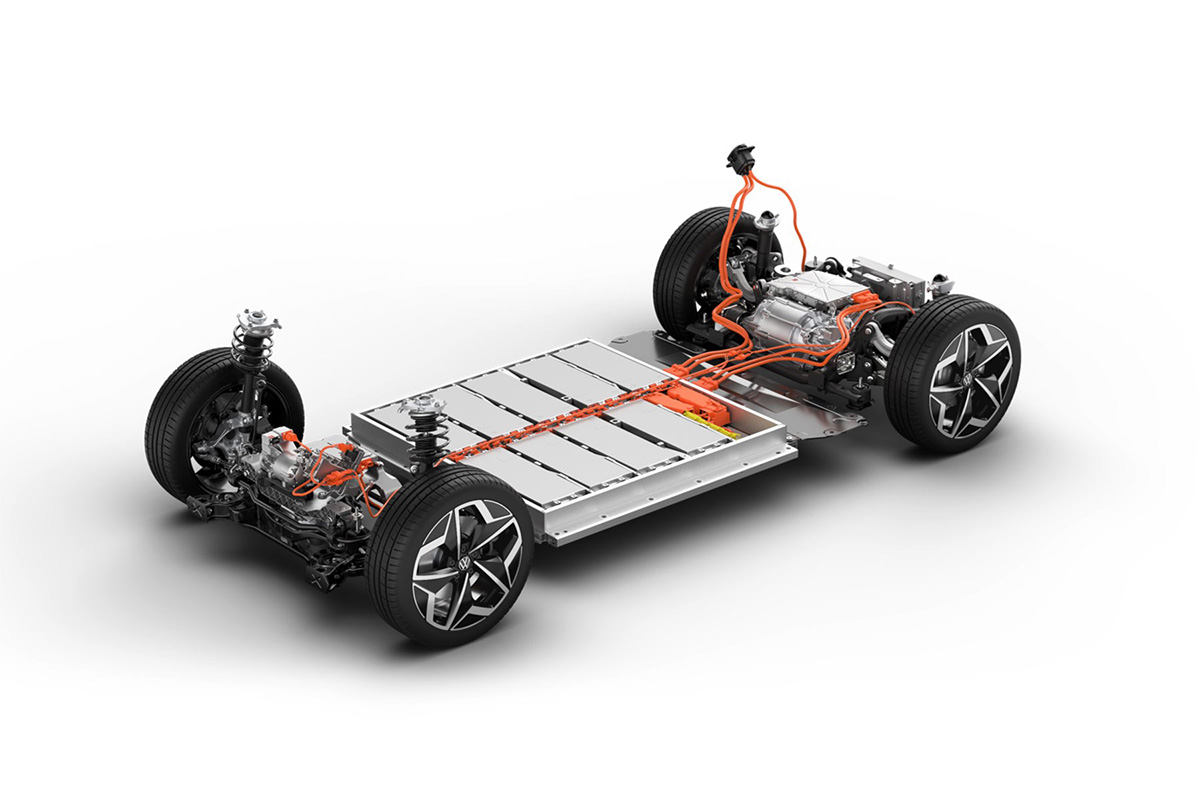

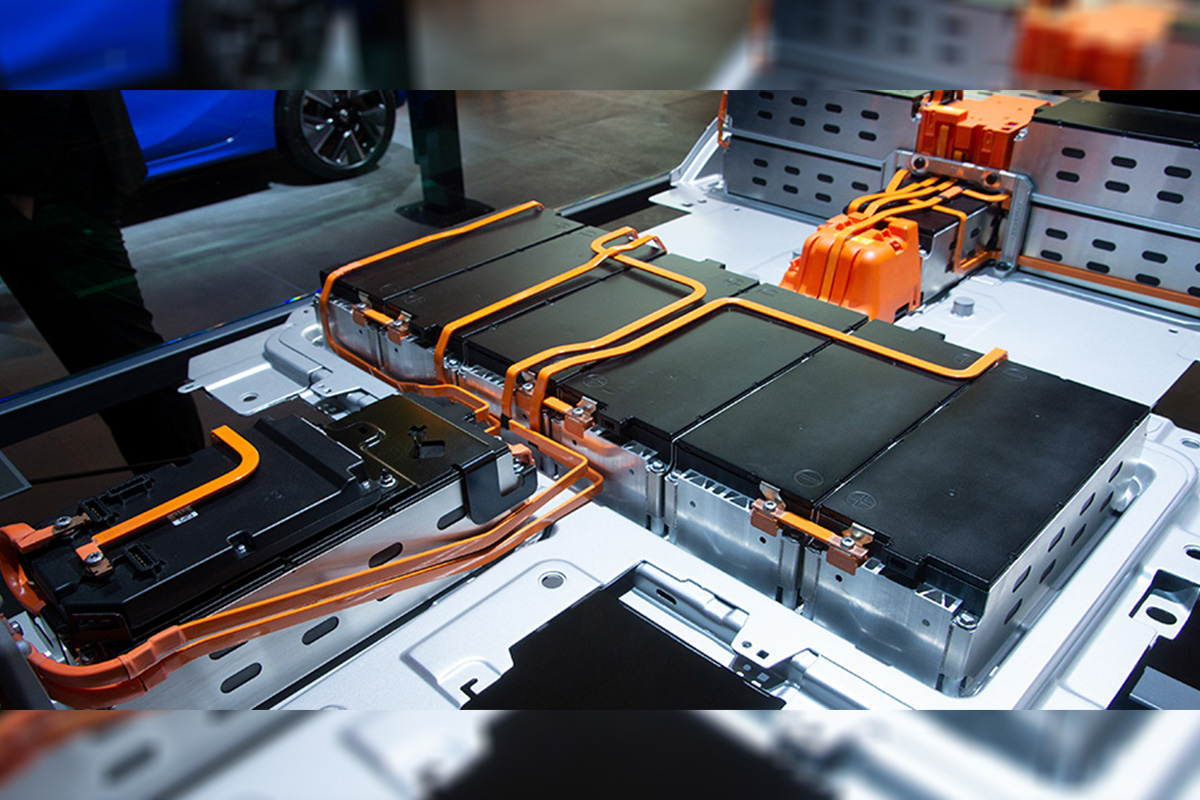

The global EV battery market is expected to witness sustainable growth (CAGR of 16%) from 2020 to 2025 due to the rising demand for electric vehicles across the world. The continuous rise in the adoption of electric vehicles due to the COVID-19 pandemic and the high fuel prices has increased the need for new technology development across the electric vehicle battery market. A startup EV battery manufacturer QuantumScape, funded by the likes of Volkswagen, has raised USD 1.5 billion intending to manufacture low-cost batteries that could lead to electric vehicles with significantly longer ranges, are safer to operate, boast longer lifespans and support faster charging. Rather than using the industry-standard mixed-metal cathode as the separator, QuantumScape has developed a solid ceramic separator. The battery is manufactured without the anode and the electrolyte making it more compact, more energy-dense, and safer to operate. When the battery is charged and discharged, the lithium metal moves through the separator and creates a thin layer of a lithium-metal anode. By using this battery, an electric vehicle could charge to 80% of capacity in 15 minutes compared to the conventional hour-long charging times.

Another EV battery manufacturer OneD Battery Sciences has created SINANODE, which integrates into existing manufacturing processes, tripling the energy density of the anode while reducing its cost per kWh by half. The higher energy density increases battery range while nanowires reduce the charging time. Leading graphite suppliers, battery and electric vehicle manufactures in the U.S., Europe, and Asia, have tested SINANODE by applying the technology to commercial EV-grade graphite used in the anodes of EV batteries. SINANODE was developed with commercial manufacturing CVD equipment available from multiple vendors, using only silane and nitrogen gases. This reduces the investments and time necessary to scale up the SINANODE step to EV quantities, while decreasing the cost of EV anodes by almost 50%, compared to the cost of most of the anodes used in EV batteries today.

Electric Vehicle Battery Industry Procurement Intelligence report, by Grand View Research, deep dives into the following insights from the industry:

- Growing adoption of electric vehicles is aiding to the growth of EV battery market

the Government of India is planning to set up 69,000 charging stations across the country by 2030. Moreover, the increasing efficiency starting from charging station set-ups to fast charging of the electric vehicle is expected to create a significant growth opportunity for the market in near future. With the growing requirement for EV batteries, the suppliers are finding newer sourcing and procurement methods for optimizing the cost of manufacturing, reducing the volatility of obtaining raw materials, and improving profitability.

- The global EV battery market is fragmented and competitive, with many large suppliers collaborating with mid-sized or small-sized companies to leverage their regional manufacturing capabilities

Leading EV battery suppliers are mostly manufacturing EV batteries for their in-house charging infrastructure development. Hence, the competition is particularly high among the smaller regional EV battery suppliers. An increase in mergers and acquisitions, coupled with diffused customer concentration, has enabled the EV battery suppliers to secure add-on offerings to realize growth in new geographies.

- Raw material costs make up the bulk of the cost head. The total cost of ownership is significantly influenced by the cost of integrating the battery in the electric vehicle. – Raw materials, including lithium, graphite, MN+Li+Co, are the biggest cost component of EV battery manufacturing; accounting for more than 60% of the total cost.

- The Asia Pacific region holds the highest share of the global EV battery market, thanks to China’s position as the leading sourcing destination due to its low cost of labor. – The majority of the big players in the market are based out of APAC. It is also the fastest-growing market, owing to the supportive policies of China’s government and the development of China as the global EV battery manufacturing hub. However, the majority of the EV battery produced in China are sold to domestic electric vehicle manufacturing companies.

EV Battery Industry – Cost Intelligence Highlights:

Grand View Research has identified the following key cost components for EV Battery Industry:

- Raw Materials

- Lithium

- Separator

- Graphite

- Mn+Li+Co

- Others

- Energy

- Labor

- O&M, Insurance

- SG&A Overheads and R&D

- Working Capital

- Taxes

- Profit

Raw material cost, the major cost component of an EV battery, accounts for more than 60% of the total cost of manufacturing.

EV battery Industry – Supplier Intelligence – Capability based ranking & selection criteria with weightage:

Operational Capabilities –

- Years in Service – 15%

- Geographical Service Presence – 35%

- Employee Strength – 15%

- Revenue Generated – 15%

- Key Clients – 12%

- Certifications – 8%

Functional Capabilities –

- Battery Type – 50%

- Lead acid

- Lithium ion

- Ni-metal ion

- o Others

- Battery Capacity (kWh) – 25%

- High (>100 KWh)

- Medium (51 to 100 KWh

- Low (0 to 50 KWh)

- Propulsion – 25%

- Battery electric vehicle (BEV)

- Plug In hybrid electric vehicle (PHEV)

List of Key Suppliers in the EV Battery industry:

- CATL

- Samsung

- LG Chem Ltd.

- BYD Company Ltd.

- Panasonic

- Tesla

- GS Yuasa International Ltd.

- Hitachi Chemical Co., Ltd.

- TCL Corporation

- Crown Battery Manufacturing

Addon Services offered by Grand View Research:

- Should Cost Analysis – Raw material cost accounted for more than 65% of the overall cost of EV battery manufacturing. Key raw materials include lithium, graphite, manganese, and cobalt. Among these, lithium has the highest cost share in overall EV battery manufacturing cost with 35%. Lithium price has been witnessing a significant drop since 2017 due to over-supply caused by an avalanche in Australia, the leading lithium producer. Labor cost is the key cost component of overhead costs. Trends of market correction in terms of salary are resulting in the rise of labor wage globally. However, salaries offered are based on region-centric policies. Therefore, shifting procurement and manufacturing practices to LCC countries could help manufacturers drive down the cost of labor.

- Rate Benchmarking – The type of EV battery is one of the most important aspects while analyzing the rate benchmarking of EV battery manufacturing. In our research, we have analyzed the rates of lithium-ion (Li-ion) batteries, sodium-nickel-chloride (NA-NiCl2) batteries, nickel-metal hydride (Ni-MH) batteries, and lithium-sulfur (Li-S) batteries. NA-NiCl2 are the most expensive batteries in the market. The average price of these batteries is 50%-60% higher than Li-ion and Li-S batteries. However, Li-ion and Li-S batteries have a 30% lower price to maximum charge ratio than NA-NiCl2 batteries. Moreover, the normal voltage of Li-ion batteries is 10% higher than NA-NiCl2, and Ni-MH batteries. Hence, using Li-ion and Li-S batteries will give more cost-benefit while installing it in an electric vehicle.

- Salary Benchmarking – Our research indicates that the Production Supervisor/Manager of LG Energy Solution, Panasonic, and Samsung SDI earn 35% higher salaries than Production Supervisor/Manager from other industry leaders like CATL and BYD. However, the YoY increment rate in such companies largely depends on KRAs.

- Supplier Newsletter – It is cumbersome for any organization to continuously track the latest developments in their supplier landscape. Our newsletter service helps them remain updated, to avoid any supply chain disruption which they may face, and keep a track of the latest innovations from the suppliers. Outsourcing such activities help clients focus on their core offerings.

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Browse through Grand View Research’s collection of procurement intelligence studies:

- Patient Engagement Solutions Market Procurement Intelligence – The global patient engagement solutions market is expected to witness sustainable growth (CAGR of 21%) from 2020 to 2025 mainly due to the rapid penetration of mhealth applications and platforms into the healthcare industry coupled with the provision of uninterrupted and rapid internet access utilizing 3G and 4G networks.

- Vitamins and Dietary Supplements Market Procurement Intelligence – The global vitamin and dietary supplements market is expected to exhibit a CAGR of 4.9% from 2020 to 2025 with capsules and tablets being the most consumable dosage form of supplements. Powder is expected to emerge as the fastest-growing dosage form from 2020 to 2025 with a projected CAGR of 6.4% from 2020 to 2025.

, the global EV Battery Market is projected to grow at a CAGR of 25.3% from

, the global EV Battery Market is projected to grow at a CAGR of 25.3% from