Klarna, a leading global retail bank, payments, and shopping service that helps consumers save time and money, be informed and in control, today revealed the new “Klarna-fied” brand identity of Stocard, one of the world’s leading mobile wallet providers that enables consumers to gather all of their loyalty cards virtually in one single place and receive personalized offers. The rebranding marks the next step of Stocard’s integration into the Klarna ecosystem following its successful acquisition by Klarna in July 2021 and opens up the doors for commercial and technological synergies between the two company’s offerings.

David Handlos, Domain Lead and founder of Stocard said: “We could not have imagined a better home for Stocard than Klarna. We both share the same customer obsession and our new look and feel expresses this joint mission superbly. With its high-touch design language and captivating photography, Stocard’s new Klarna-fied branding both enhances our user experience and helps us better attract new audiences. And the brand is just the beginning. Our users and retailers can look forward to powerful new features coming their way soon as we tap into Klarna’s vast pool of talent and resources.”

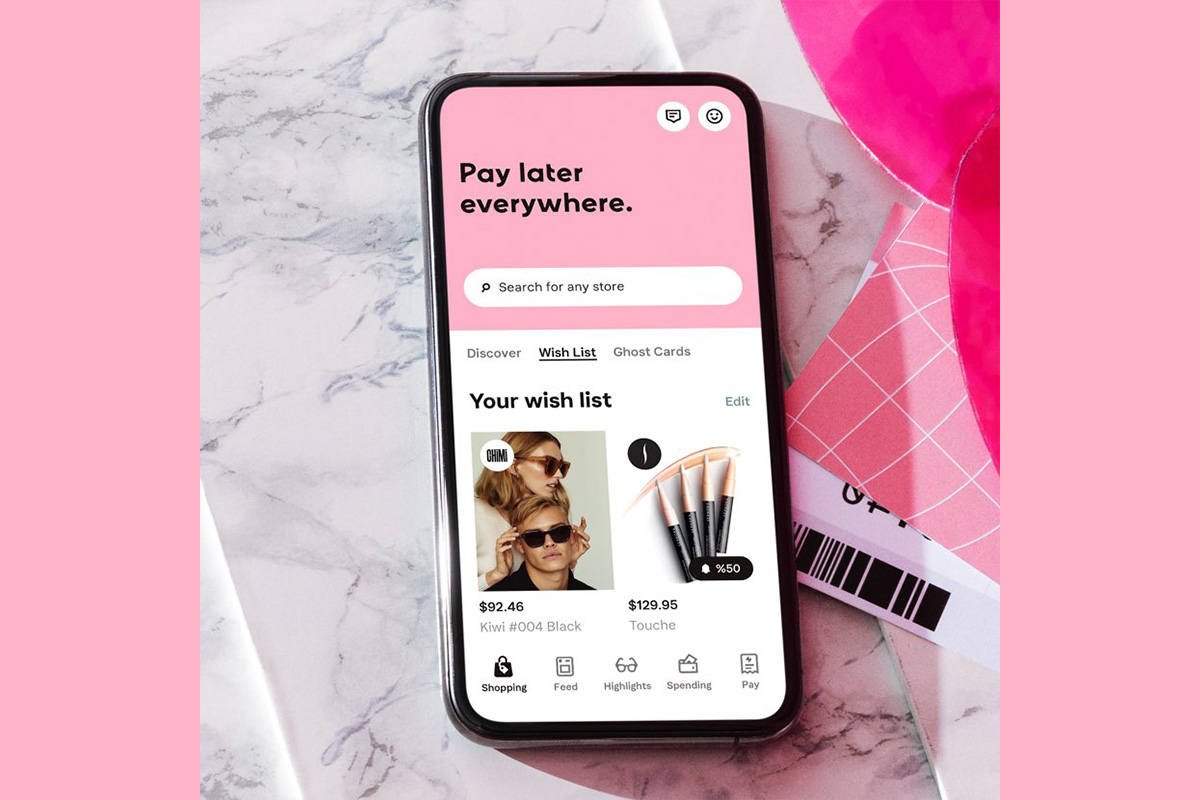

The Stocard app lets consumers virtually store all of their loyalty cards, collect coupons and rewards, receive personalized offers, and even make mobile payments with a virtual prepaid card*. For retailers, the Stocard app offers a powerful data-based channel to engage consumers, drive traffic, sales and loyalty and understand consumer preferences.

The Stocard app will continue to be available for free to its 47 million active consumers across 45 markets and will be enriched with further features going forward as it integrates deeper with Klarna’s platform. At the same time, Stocard’s team will carry their domain expertise into Klarna’s product teams and develop new features in the Klarna app, the first of which will be revealed in the very near future.

David Fock, Klarna’s Chief Product Officer commented: “At Klarna, we want to help consumers save time and money every time they pay, whether that is online or in-store. With its clever mobile wallet solution, Stocard fulfills this very promise, making it the perfect addition to the Klarna family. By putting the consumer at the heart of every interaction, Klarna has flipped the script on how a bank should act, and this is reflected in our “Smoooth” look and feel. With the rebranding of Stocard we are now transporting the “Smoooth” experience to Stocard’s consumers and retailers across the globe. Above and beyond significantly broadening Klarna’s global footprint by a colossal 47 million consumers across 25 new markets, the acquisition of Stocard also allows us to embed the deep intelligence packed into Stocard’s payment and marketing technology into the Klarna app, with exciting new features to be announced very soon.”

Alongside Toplooks, HERO, APPRL, Inspirock and, most recently, PriceRunner, the acquisition of Stocard adds a further complementary pillar to Klarna’s unparalleled product offering. Spanning from virtual shopping, content creation and dynamic ads to travel planning and mobile wallets, Klarna’s acquisitions are delivering on the promise of saving time and money for more than 147 million consumers and helping its 400,000+ retailers engage their target audiences even more effectively. Especially for retailers aiming to seamlessly bridge their online and in-store shopping experience, omnichannel services like the Stocard app have become essential in winning over and retaining a new generation of shoppers.