Inviting the world to ‘Meet Visa,’ the global payments technology company today unveiled the initial phase of its brand evolution spotlighting the diverse capabilities of its network and commitment to enabling global economic inclusion. Aligned closely with the company’s business strategy, this phase includes the debut of a dynamic global marketing campaign and a preview of a modernized look for Visa’s iconic brand.

More than 60 years ago, when Visa was founded, few could imagine a world beyond cash and checks. Visa’s founding vision to introduce a more secure, reliable and convenient currency in digital form began with a simple question: what if money became fully electronic? Today, Visa continues to anticipate the future of digital commerce, providing access through its secure global network working for everyone, everywhere.

“People think they ‘know’ Visa. Consumers and businesses trust the power of those four letters and see it when they open their wallet, pay a vendor, walk into a store or check out online. What they don’t see is how those four letters operate the most dynamic network of people, partnerships and products,” said Lynne Biggar, Executive Vice President and Global Chief Marketing Officer, Visa. “We are on a mission to ensure that Visa is seen as more than a credit card company and understood as a trusted network that drives commerce forward.”

While Visa continues to shape the physical and digital credit or debit card transaction, it also increasingly sits at the center of enabling money movement. A company built on access to economic inclusion, the Visa network connects 3.6 billion credentials, over 70 million merchant locations, tens of thousands of partners and powers more than $11 trillion in total volume annually. Over the last five years alone, Visa has invested $9 billion in technology to shape the future of commerce, delivering a differentiated set of products, services and benefits.[1] Visa’s network helps enable a gig-worker with the flexibility to get paid in real time, facilitates person to person payments that can send and receive money between billions of cards and accounts worldwide, and large corporate payments to be made more effortlessly across borders, as just a few examples.

Illustrating the scope of Visa’s capabilities, initial elements of Visa’s brand evolution include:

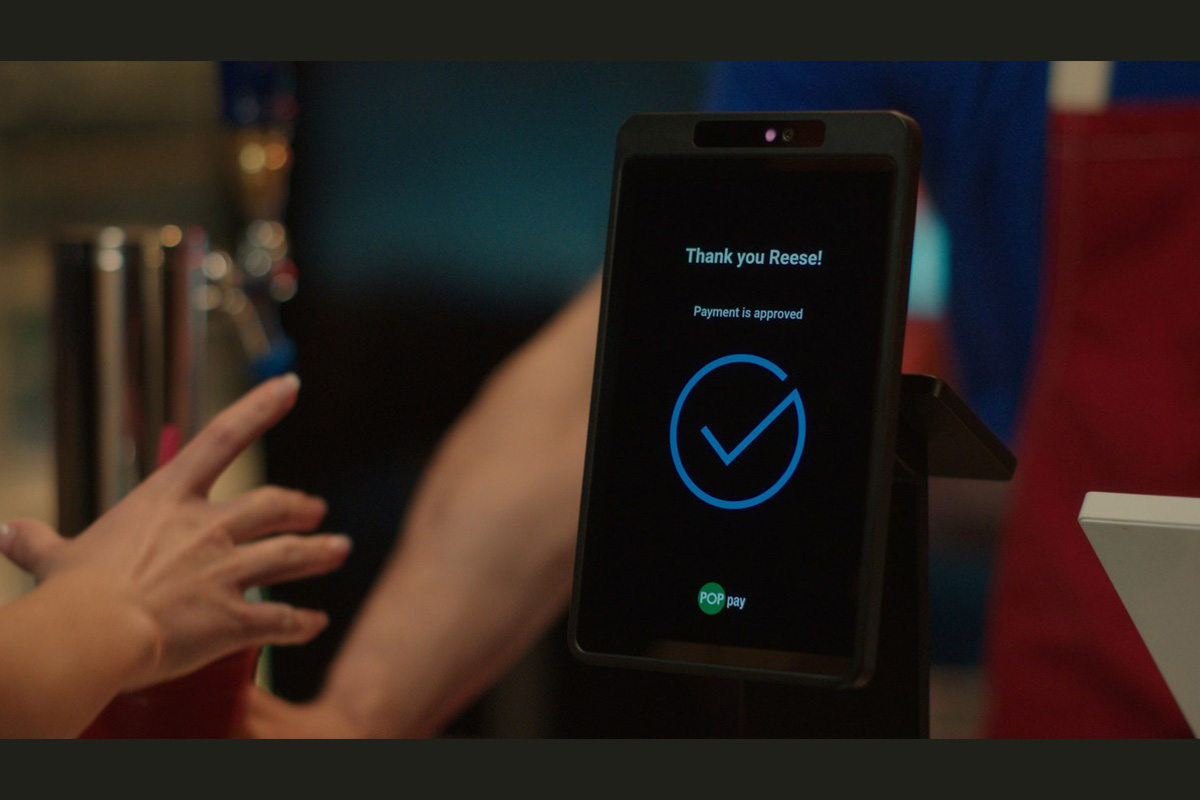

‘Meet Visa’ films spotlight the power of the network. Developed by Visa’s global creative agency of record, award-winning Wieden+Kennedy, Visa is unveiling a short film directed by Malik Hassan Sayeed that invites the world to ‘Meet Visa,’ a network working for everyone. Complementing this introductory film is a series of shorter digital films and photography that showcase the breadth of the Visa network working to provide access and advancing commerce for real people in real places around the world. Brought to life by some of the best and most diverse creative talent including Sayeed, Visa also worked with photographer Camilla Falquez and Argentinian directing team Pantera & Co. – Brian Kazez, Pato Martinez and Francisco Canton – to vividly capture moments such as:

New Visa brand identity symbolizes change. Visa has long stood for trust, security, acceptance and inclusion. These core values, in addition to the goal of enabling access for everyone to participate in the global economy, will be expressed through a modernized, dynamic visual brand identity, built in partnership with leading global brand design firm Mucho. The ‘Meet Visa’ campaign shares an initial glimpse into the evolved visual brand identity launching later this year, featuring refreshed colors for digital impact, a custom font created for optimal digital experiences and an updated brand symbol designed to express the purpose behind the organization.

Over the course of 2021, Visa’s new brand identity will become visible in all 200+ countries and territories Visa operates in, cutting across the company’s primary business strategy encompassing:

- Consumer payments, focusing on expanding access and moving the $17 trillion spent in cash and checks globally to digital payments.

- New payment flows including cross-border person-to-person payments and a range of value-added services that help businesses of all sizes navigate today’s landscape; identify new growth opportunities; and maintain our mission of making Visa the most secure, resilient and reliable network.

- A diversity of offerings and solutions through burgeoning partnerships with fintechs and established brands, relationships with governments around the world and innovative technology built for the future.

“We are capturing the bold ambition of Visa with this brand evolution as a way to express what we stand for and what we strive for,” continued Biggar. “With the world reopening and with money increasingly moving in new ways, there’s no better time to showcase the work we do and the impact a purpose-driven brand with Visa’s scale can have to enable individuals, businesses and economies to thrive.”

, that rewards users up to 1.5% in Bitcoin for any purchases made with their debit card.

, that rewards users up to 1.5% in Bitcoin for any purchases made with their debit card.