Looking Glass Labs Ltd. (“LGL” or the “Company”) (NEO: NFTX) (AQSE: NFTX) (OTC: LGSLF) (FRA: H1N), a leading Web3 platform specializing in immersive metaverse environments, play-to-earn tokenization and blockchain monetization strategies, is pleased to provide a summary of its most significant achievements from throughout 2022. Additionally, management is providing its outlook for the Company and its wholly owned subsidiary, House of Kibaa (“HoK“), for 2023.

Outlook

2022 was a fascinating year in technology, but many investors can be forgiven for still having difficulty discerning the technology-based sectors on the bleeding edge of innovation. Despite LGL being an early mover in the metaverse space with its own set of notable achievements, the Company continues to evolve in an industry that is, so far, better known for other reasons. Ever since Facebook became Meta last October and then proceeded to invest another nearly US$15 billion into the metaverse, the industry has produced mixed results including but not limited to NFT darling, Yuga Labs, achieving a $4 billion valuation just under one year into its existence.

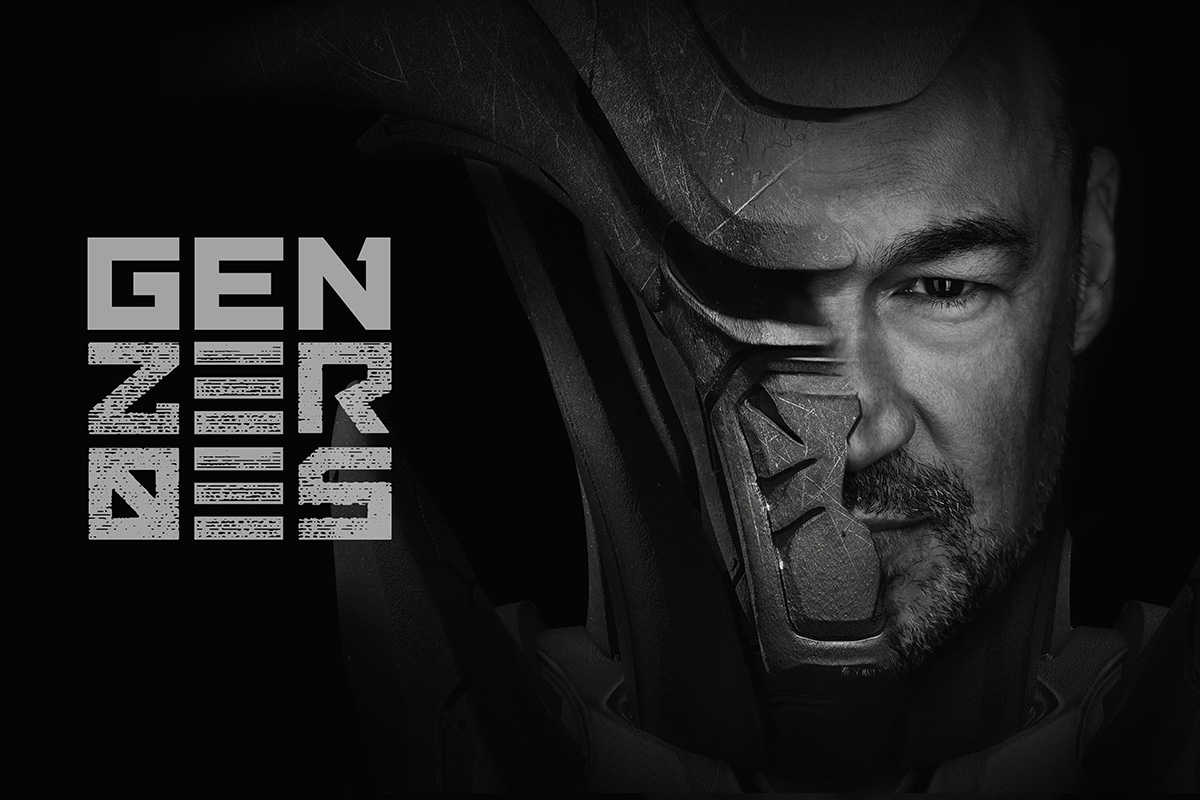

Looking ahead to 2023, LGL continues to be focused on building industry leading products that are firmly rooted in immediate consumer engagement with the continued development of the first live-action series, entitled GenZeroes, as well as its proprietary metaverse platform, Pocket Dimension, which is expected to come to market in the first quarter of 2023. These two flagship products are blurring the lines between familiar user experiences and Web3 technology applications to provide corporate and brand partners with new ways to engage their customers. LGL is actively pursuing partnerships with multiple major brands and organizations across the media, marketing, automotive and entertainment industries to leverage the improved engagement and monetization benefits for which the blockchain and Web3 have great potential.

2022 Highlights

LGL’s most notable highlights from 2022 in chronological order include:

- 3D modelling technology of HoK’s NFT infrastructure became core to the development of the HAPEBEAST NFT collection by Digimental Studio that realized in excess of $100 million in secondary revenues1;

- HoK partnered with Polygon Studios to scale and further develop key infrastructure solutions;

- Received over CAD$2.5 million in Metaverse land sale proceeds in April 2022;

- Produced and release the first-ever live action sci-fi series backed by NFTs;

- Showcased HoK’s GenZeroes Live-Action Series at Comic-Con International 2022; and

- Launched Alpha Release of Pocket Dimension Metaverse Assets at the beginning of November.

Further information regarding the Company’s news releases and accomplishments can be found here.

Management Commentary

“I am proud of the Company’s accomplishments this year, thanks to the hard work and dedication of our entire enterprise including both LGL and HoK. Looking back, I am grateful for both our successes and our challenges as they have helped shape the Company that we have today,” said Dorian Banks, Chief Executive Officer at LGL. “Going forward, our management team believes that there is currently more opportunity than ever in the metaverse industry. We intend to pursue significant contracts and important partnerships in 2023 as major global brands continue to announce Web3 initiatives,” added Mr. Banks.