The instant availability of Altair’s HPC resources means that designers, engineers, and data scientists can run their complex projects without any need for the support of in-house HPC infrastructures. Altair One offers the ability to provision turnkey, scalable appliance clusters across all major cloud providers including Amazon AWS, Microsoft Azure, Oracle Cloud Infrastructure, and Google Cloud Platform in just a few mouse clicks.

The launch of Altair One establishes a robust roadmap of progressive development in features and functionality. By providing organizations the flexibility to seamlessly migrate workloads between cloud providers and on-premises environments, Altair One empowers teams to pivot quickly and embrace new technology while avoiding vendor lock-in.

Anytime, anywhere access to world-class tools and HPC

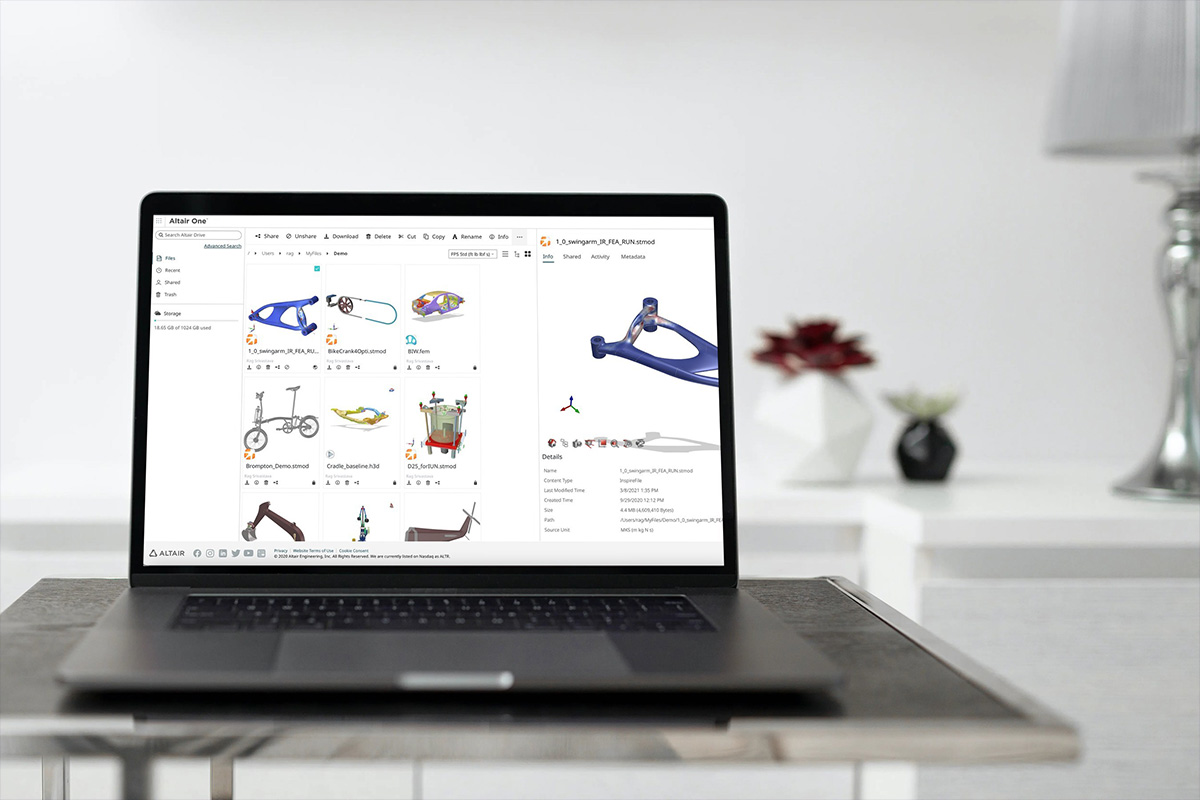

Altair One is a single portal for Altair’s products, accessible anywhere via standard workstations, PCs, laptops, and mobile devices. Users also have access to exclusive Altair One tools including:

- Altair DesignAI

– Combines physics-based simulation-driven design and machine learning-based AI-driven design to create high-potential designs earlier in development cycles

– Combines physics-based simulation-driven design and machine learning-based AI-driven design to create high-potential designs earlier in development cycles

- Altair Material Data Center

– A multi-domain material properties repository to help create sustainable, efficient, minimum-weight designs

– A multi-domain material properties repository to help create sustainable, efficient, minimum-weight designs

“Altair is a leader in simulation, HPC solutions and workload management. Altair One is a key differentiator because of its ability to provide seamless access to the cloud and delivers unmatched value for Altair’s customers,” said Nidhi Chappell, GM Workload Optimized Compute, Microsoft.

“The integration of Altair One with Oracle’s next-generation cloud infrastructure provides customers the ability to leverage fast and scalable computing in a highly secure environment – including bare-metal HPC servers and GPUs – for complex simulations,” said Clay Magouyrk, executive vice president, Oracle Cloud Infrastructure. “Together, Oracle Cloud Infrastructure and Altair One put the power of HPC at the fingertips of customers everywhere – without having to purchase expensive hardware, leading to improved productivity and optimized resource utilization.”

Data-driven development with AI- and ML-enabled analytics

Altair One facilitates a truly data-driven approach to product development. Designers, IT specialists, and the C-suite can build deeper insight and reach better decisions faster with Altair’s AI and machine learning (ML) enabled data analytics and data management tools. Diverse teams can work on the same models, with ubiquitous access ensuring effortless knowledge sharing and data transfer. The full value of both current and historic simulation and analysis is therefore realized.

Flexible, scalable HPC support

Altair One provides simple HPC access portals for end-users and intuitive management portals for IT administrators. Powered by Altair PBS Works , Altair One leverages the same workload management technology used by many of the world’s Top 500 HPC systems and foremost supercomputing centers. Altair One does not require additional capital expenditures on complex IT and can scale immediately in response to peaks in workload.

, Altair One leverages the same workload management technology used by many of the world’s Top 500 HPC systems and foremost supercomputing centers. Altair One does not require additional capital expenditures on complex IT and can scale immediately in response to peaks in workload.

Flexibility is further enhanced by Altair Units, Altair’s patented, subscription-based licensing model that allows organizations to pay only for what their employees need, when they need it.

Additional notable features in Altair One include the ability to:

- Launch applications in the cloud instantly with zero download

- Run complex HPC solver jobs in the cloud within a simple, intuitive user experience

- Provision turnkey, scalable appliance clusters in just a few mouse clicks

- Securely upload, access, store, and manage data using the Altair One drive

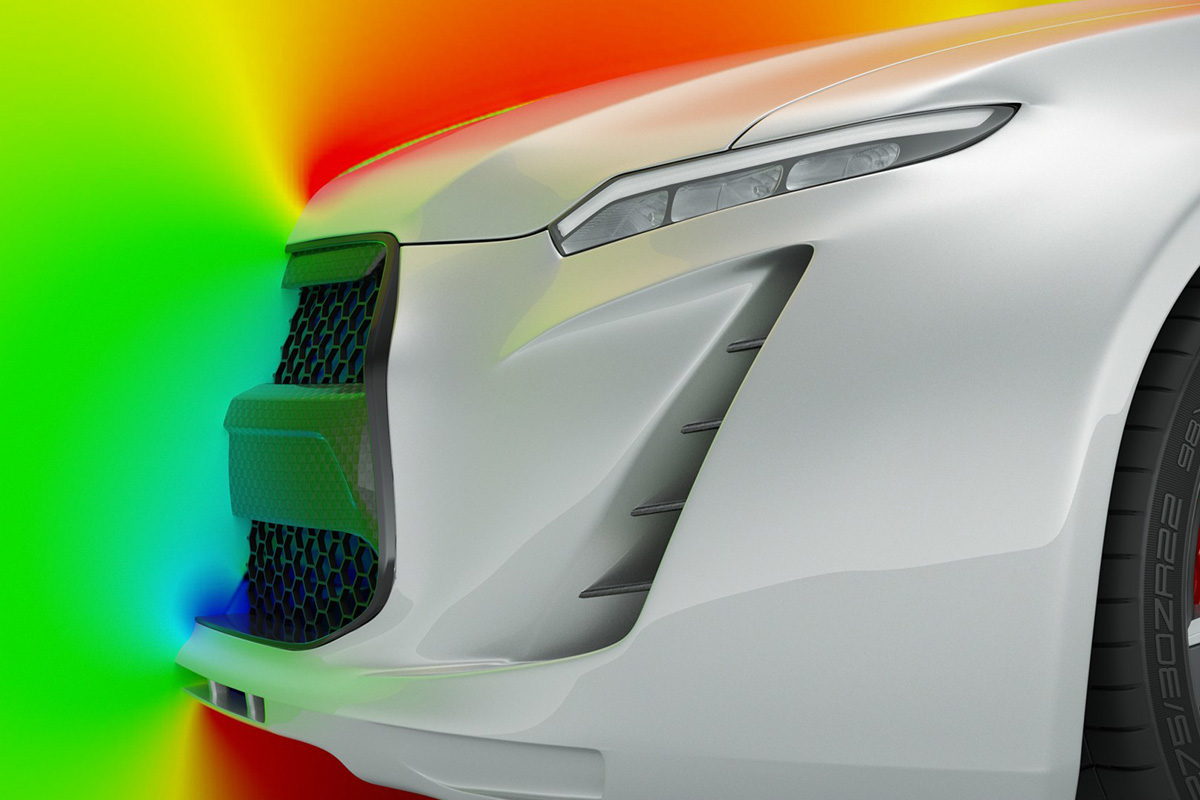

is a cost-effective alternative to purchasing individual tools from multiple software vendors by delivering all major CFD solutions under a single license including:

is a cost-effective alternative to purchasing individual tools from multiple software vendors by delivering all major CFD solutions under a single license including: